Perspectives

Stay up-to-date with the current investment and macroeconomic issues at ClearBridge Investments. We provide analyses of the themes and trends which lie at the heart of your investment challenges.

ClearBridge Investments 2025 Stewardship Report

Our eighth annual stewardship report efforts offers an in-depth view of the latest in ESG integration and sustainability investing at ClearBridge, including how we are engaging with portfolio companies and voting proxies on pressing environmental, social and governance issues.

More...

ClearBridge Investments 2024 Stewardship Report

ClearBridge Investments' annual stewardship report highlights how active ownership benefits from ESG integration and how company engagements and proxy voting create value and drive positive change.

More...

ClearBridge Investments 2023 Stewardship Report

A compendium of our recent best thinking on the impact of ESG integration and engagement, ClearBridge Investments' 2023 Stewardship Report is an index to topics that will dominate investment conversations in the months and years ahead.

More...

Global ESG Outlook: More Scrutiny on Sustainable Investments

Regulation, biodiversity and human and labor rights should remain a focus for sustainability-minded investors in 2023.

More...

Inflation Reduction Act Deepens the Decarbonisation Bench

The U.S. Inflation Reduction Act offers strong tailwinds for ClearBridge holdings in the renewable energy and electric vehicle supply chains, as well as companies helping the climate with solutions in buildings and energy efficiency.

More...

An ESG Framework for Extractive Industries

In our latest white paper, we examine the key ESG considerations required for investing in minerals necessary for the energy transition. They offer a framework for engaging mining companies on ESG risks and outline some best practices ClearBridge has identified.

More...

ClearBridge 2022 Stewardship Report

The annual report highlights salient engagements ClearBridge has had with management teams at both large cap and small cap portfolio companies on pressing sustainability issues and details how we are assessing sustainability risks and opportunities such as climate change and diversity, equity & inclusion across the firm.

More...

Acquiring a Taste for Climate-Friendly Food

Dimitry Dayen and Rob Buesing break down how agriculture is evolving to fight climate change through plant-based foods and other budding technologies.

More...

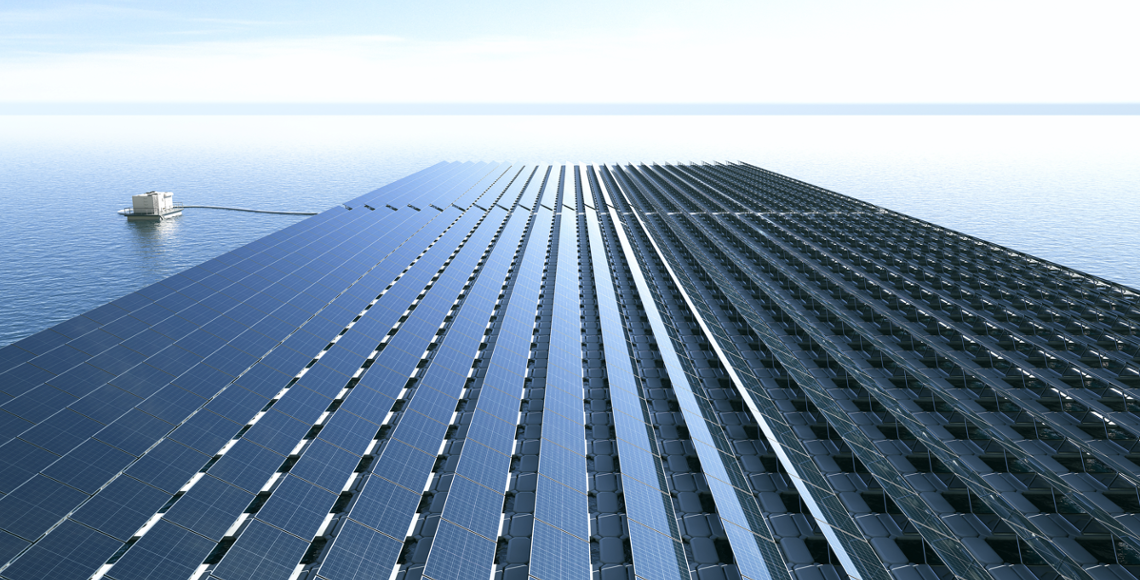

An Active Bet on Emissions Reductions in Energy Sector

The focus of the energy transition is on shifting the incredibly complex power supply curve from thermal-based sources of energy to renewable energy, while still allowing demand for energy to keep growing.

More...

Achieving ESG Goals with a Quality Approach to Value

An active approach to value investing enables a dual purpose of generating alpha and satisfying ESG objectives.

More...

ClearBridge 2021 Impact Report

Our 2021 Impact Report: Partnering for Change in a Time of Adversity, offers a thorough look at the sustainability issues ClearBridge has been addressing over the past year with portfolio companies, shareholders and industry organizations through ESG integration, engagement and proxy voting.

More...

Sustainability for infrastructure assets

Listen to Portfolio Manager Shane Hurst discuss how ClearBridge Investments incorporates ESG in the investment process.

More...