Acquiring a Taste for Climate-Friendly Food

Key Takeaways:

-

The face of agriculture is changing as it adapts to and mitigates climate change, with the development of plant-based foods, carbon capture technology, regenerative farming and renewable natural gas having a growing impact.

-

While many look to plant-based milk for emissions reductions just as they do to plant-based meats, there are many variables that drive the total environmental impact of a product.

-

Food companies are exploring the use of regenerative agriculture practices to grow crops used in everyday food products, seeking to cultivate healthier soil and cleanse the air of legacy carbon emissions.

With agriculture and the food industry emerging as a focus for sustainability-minded consumers and investors looking to mitigate climate change and bolster biodiversity, there could be much at stake in your next meal. Agriculture finds itself doubly beset by climate change challenges: it is at once a large emitter of greenhouse gases contributing to climate change and a victim of the effects of climate change on ecosystems. Indeed, two goals of COP26, the 2021 U.N. Climate Change Conference — curtailing deforestation (often related to growth of agricultural land) and building resilient agriculture — highlight this dual nature of agriculture.

Accordingly, food companies and consumers have a host of solutions at their disposal, although there are few easy fixes, and often appearances don’t align with reality. With the growing popularity of plant-based foods, the development of carbon capture technologies and the advent of — or return to — regenerative farming, the face of agriculture is changing as it adapts to and mitigates climate change. Some of these developments may be visible in the grocery store aisle and some may not, but all are now part of how we put food on the table.

The Plant-Based Foods Proposition

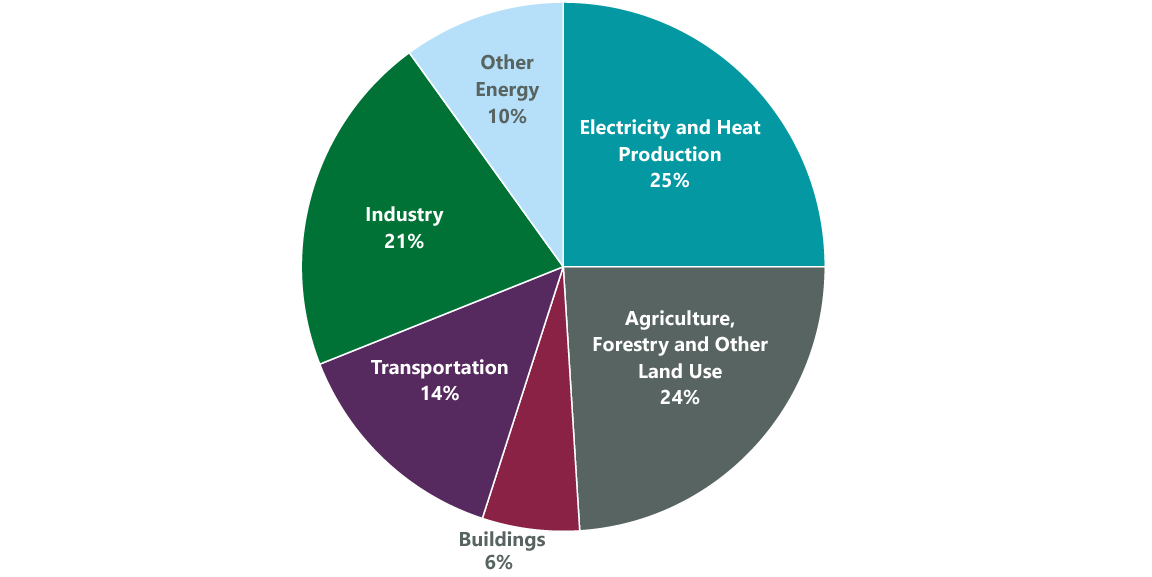

Although there are many arguments for increasing the proportion of plant-based foods in our diet, helping solve the emissions problem of animal-based agriculture is usually near the top of the list. Agriculture accounts for roughly a quarter of global greenhouse gas (GHG) emissions (Exhibit 1), with animal feed, transportation, manure storage and processing, as well as deforestation to expand farmland for crop growing and grazing among contributing factors.1

Exhibit 1: Food-Related GHG Emissions (26% of Total GHG Emissions)

Source: IPCC, 2014.

The biggest source of emissions in agriculture is the carbon dioxide (CO2) and methane produced by livestock, essentially due to food digestion. There are also emissions from manure and equipment typically used in the field. Some estimate these three factors represent as much as two-thirds of the emissions associated with agriculture. Fertilizer also results in carbon emissions, as does deforestation. An important point here is that trees and oceans are natural carbon capture and storage mechanisms — they are carbon sinks that naturally absorb CO2 from the atmosphere. To the extent they are not preserved and nurtured, the Earth’s natural carbon absorption capability is reduced.

Plant-Based Foods Offer Efficiency Gains

Beef and milk production account for most of the world’s agricultural emissions, and it is here plant-based foods offer the greatest gains. Most of these gains are through efficiency. Roughly a quarter of Earth’s ice-free land is used for livestock grazing; plant-based meat, however, uses 47%–99% less land than conventional meat, according to studies.2 In terms of emissions, plant-based meats emit 30%–90% less greenhouse gas than conventional meat.3

It’s possible to see plant-based foods as more efficient than animal-based foods not just in the land they require, but in the energy they provide. Animal-based proteins are in effect an extra (and some would argue unnecessary) step in the food chain, considering the amount of plant matter and water it takes to grow an animal to full size to be slaughtered and produce animal protein. Some estimates suggest that over 50% of global food-related emissions come from animal-based products, yet they yield just under 20% of consumed calories. In a way, plant-based foods are to animal-based foods what the electric powertrain is to the internal combustion engine: a more efficient energy source.

At the same time, changes in consumer preference are already reducing the harmful climate effects of cultivating beef. Changes in consumption from beef to chicken have resulted in less land used for meat production. From 1961 to 2016, although pastureland expanded by an area almost the size of Alaska, land use peaked in 2000 and then declined due to a shift to chicken production and consumption and the increased use of industrial farming methods.4 In other words, there is evidence we may be already shifting away from heavier-emission meat consumption.

Further, the overall emissions gains from switching from conventional meat to plant-based meat may be less than they first appear. Although going vegetarian in a developed country reduces GHG emissions from agriculture, total emissions decline only slightly, with one study finding only a 4%–5% reduction in CO2 footprint, on average.5 This is because a cheaper plant-based diet frees up money for consumer goods, the greater consumption of which offsets much of these CO2 “savings.”

The Almond Versus the Oat

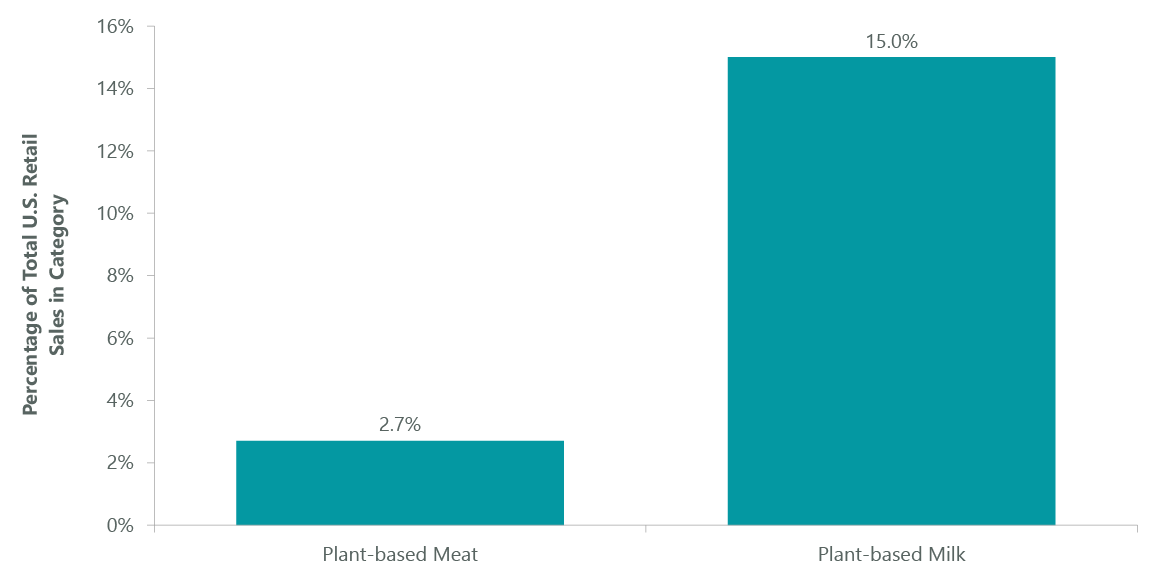

For all the attention plant-based meats have received since Beyond Meat went public in May 2019, it is plant-based milks that are the most advanced in terms of category development. Whereas plant-based meat accounted for 2.7% of total U.S. retail packaged meat sales in 2020,6 plant-based milks represented 15% of all dollar sales for retail milk.7

Exhibit 2: Plant-Based Meats and Milk

Source: Food Dive, 2021; Good Food Institute, 2021.

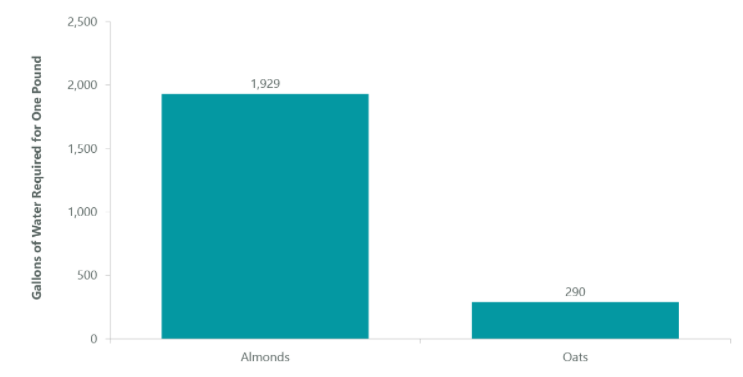

Yet while many look to plant-based milk for emissions reductions just as they do to plant-based meats, there are many variables that drive the total environmental impact of a product, and emissions are not the only factor to consider. The overall environmental impact can vary quite widely depending on the plant substrate. By a wide margin, almond milk, for example, has significantly lower direct emissions than dairy milk. Almonds don’t create the emissions cows do. But the water usage of almonds is significant. It takes about three gallons of water just to grow a single almond through its growth cycle. Furthermore, roughly 80% of almonds are grown in California, a water-stressed state subject to extreme drought conditions.

Stressing water resources can also lead to negative climate effects as water shortages contribute to climate change. Globally, droughts result in reduced electricity generation from hydroelectric plants, which in turn increases reliance on coal and natural gas plants for power, exacerbating emissions problems. High liquified natural gas (LNG) prices in 2021, for example, are partially linked to drought conditions in Brazil, where LNG imports rose 60% through the first half of the year.8

Oat milk, on the other hand, solves some of these problems. It has similar overall emissions as almond milk — both represent roughly an 80% reduction in emissions over dairy milk — yet oats are much easier to grow than almonds, growing essentially anywhere and in variable conditions. Most importantly, oats can be grown in non-water-stressed areas (Exhibit 3).

Exhibit 3: Water Requirements to Grow Oats and Almonds

Source: Mekonnen, M.M. & Hoekstra, A.Y. (2011) The green, blue and grey water footprint of crops and derived crop products, Hydrology and Earth System Sciences, 15(5): 1577-1600.

Consumer taste is also relevant here, as consumers have been gravitating toward replacing almond milk and soy milk with oat milk, citing oat milk’s superior taste. The category is most advanced in Europe, where Swedish company Oatly has been a pioneer.

Consumer Taste Reigns, and May Be Changing

For any diet-based strategy geared to lowering carbon emissions, consumer taste is a critical variable. In the case of plant-based meat, the category must appeal to consumers beyond the vegetarian and vegan cohort that make up roughly 5% of the U.S. population. Data suggest many omnivores are trying plant-based foods, in particular plant-based meats. With NDP group survey data suggesting 90% of those trying plant-based meats are not vegetarian or vegan, plant-based foods appear to be getting traction with the broad population.

Is Carbon Capture an Agriculture Emissions Strategy?

Agriculture emissions will remain significant regardless of the mix of plant-based and animal-based products, and managing these emissions will only grow in importance. One major development on this front is carbon capture technology, which aims primarily to capture CO2 produced by power generation or industrial activity such as steel or cement making, then either transport it for safe underground storage (carbon capture and storage or CCS) or reuse it in industrial processes (carbon capture, utilization and storage or CCUS).

While carbon capture technology is still being developed, and is most pertinent to heavy industry like power, steel and cement, one form of carbon capture — direct air capture — is increasingly relevant for food makers. Direct air capture is a process for capturing CO2 directly from the ambient air, primarily with large vacuums and filters that suck in air and filter it, isolating the CO2.

Because CO2 is widely used as an input in the food industry, food companies have an incentive to innovate sustainable ways to secure it. For example, Climeworks, a Swiss company, specializes in equipment that captures CO2 from the atmosphere and sells it to a variety of businesses, including Valser, a sparkling water brand owned by Coca-Cola. Food, beverage and agriculture is one of three major market segments to which Climeworks sells, in addition to renewable fuels and CO2 removal.

The feasibility of selling recycled CO2 in part explains the interest of Microsoft in Climeworks; the software giant is investing in Climeworks’s Iceland facilities, which aim to significantly scale up direct air carbon capture capabilities. At present, the cost of producing recycled CO2 is fairly prohibitive. It costs Climeworks roughly $600 per ton to remove the CO2 from the air, whereas CO2 retails for as little as $150 per ton. But the goal is to scale and reduce the costs of recycled CO2, and given the many uses of CO2 in the food industry, having a source of recycled CO2 could be valuable. CO2 is widely used in the food industry for applications such as removing the caffeine from coffee beans to make decaffeinated coffee and for carbonating beer and soft drinks. It is also used for cooling in the food and manufacturing industries. The World Resources Institute estimates that with supportive policy and market development, the cost for direct air capture could fall to $150–$200 per ton over the next 5–10 years.

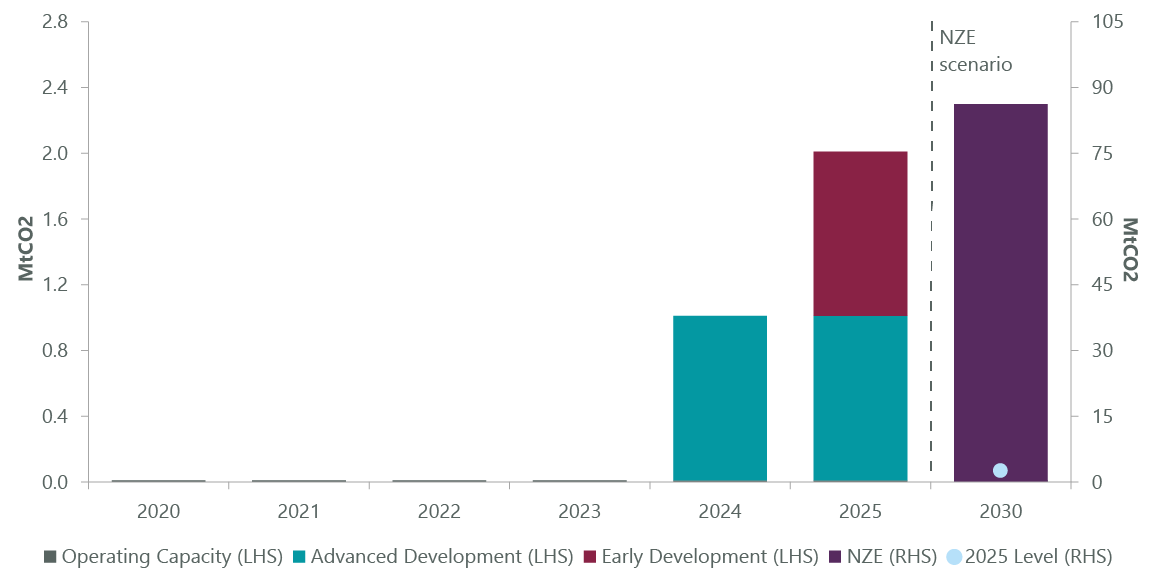

Aside from cost, there are other challenges to direct air capture. One is that putting recycled CO2 into beverages simply returns the CO2 to the atmosphere when those beverages are opened. A response to this might be that direct air capture creates a virtuous circle that does not entail any additional emissions; it just manages existing emissions in a better way. The fact that it offers an economic return — a use case for captured carbon, where storing it underground provides none — could also incentivize faster development of the technology. Faster development of direct air capture technology will be key in ramping up operations, as the world is far from the direct air capture capacity needed in any net-zero scenario (Exhibit 4).

Exhibit 4: CO2 Capture by Direct Air Capture 2020–2030

As of Oct. 2021. Source: IEA. NZE: Net Zero Emissions by 2050 Scenario. 2025 comparison shows sum of operating capacity, early development and advanced development.

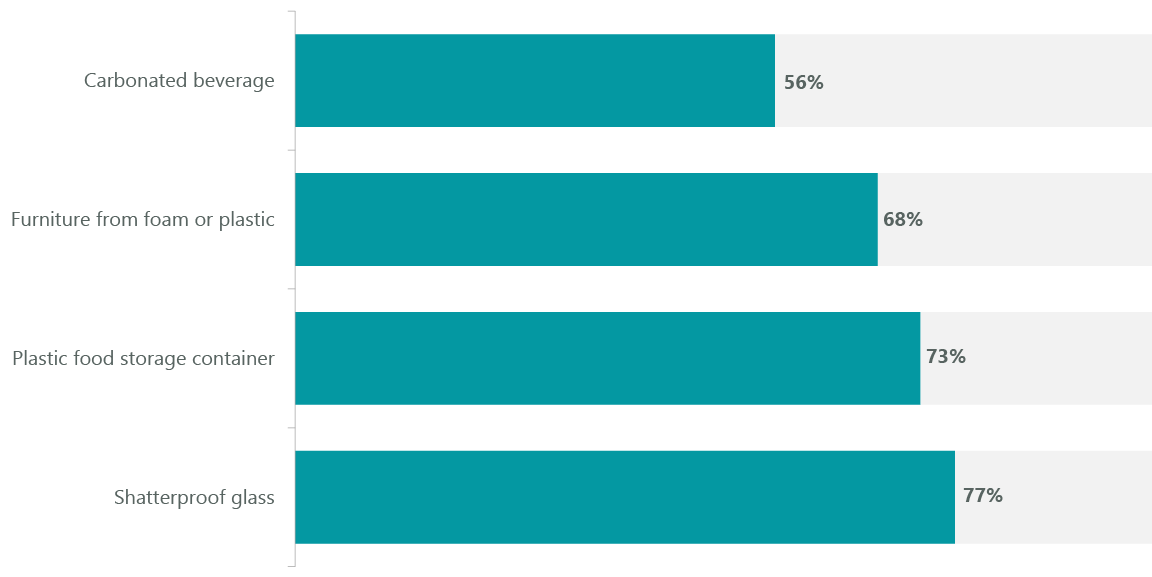

Another challenge might be getting consumers interested in food products made using recycled CO2. One study found carbonated drinks raised the most concern of several products made from recycled CO2 (Exhibit 5). At the same time, the carbonation in drinks is generally a fossil fuel byproduct from the steam-methane reforming process. So long as the process is in line with food-grade safety regulations, it should be no different for the consumer, even if the method of procuring it is novel.

Exhibit 5: Consumer Willingness to Use Products Made with Captured CO2

As of May 2021. Lutzke, L., Árvai, J. Consumer acceptance of products from carbon capture and utilization. Climatic Change 166, 15 (2021).

Closing the Carbon Cycle with Regenerative Agriculture

While recycling CO2 into food and beverage products can create a virtuous circle of carbon, even on a small scale, broader thinking along these lines has led to the concept of regenerative agriculture, which aims to draw down CO2 from the atmosphere through cultivating healthier soil. Regenerative agriculture seeks to develop agricultural practices that complete the carbon cycle, in which CO2 moves from living beings to the atmosphere and back to living beings on earth or in the soil. Photosynthesis offers the clearest paradigm for this: in it, plants remove CO2 from the atmosphere and use it to produce oxygen and sugar, or the air we breathe and the basis for the food we eat. In effect, healthy soil and plants are a natural carbon sink.

Regenerative agriculture seeks to “invert the carbon emissions of our current agriculture to one of remarkably significant carbon sequestration thereby cleansing the atmosphere of legacy levels of CO2” according to the Regenerative Agriculture Initiative and The Carbon Underground, whose definition of the practice has dozens of food company signatories. Practices involve:

- No-till/minimum tillage, to enable soil aggregation, water infiltration and retention and carbon sequestration.

- Using cover crops, crop rotations, compost and animal manures to increase soil fertility, instead of relying on synthetic and artificial fertilizers, which require energy to produce and transport, degrade water and atmosphere and accelerate decomposition of soil organic matter, among other effects.

- Build biological ecosystem diversity through multiple crop intercrop plantings, or intercropping, among other practices (planting crops that can grow well together, such as corn, beans and squash).

- Improving grazing practices, moving away from feed lots and confined animal feeding systems, to stimulate plant growth, increase soil carbon deposits, and make pasture and grazing land more productive.

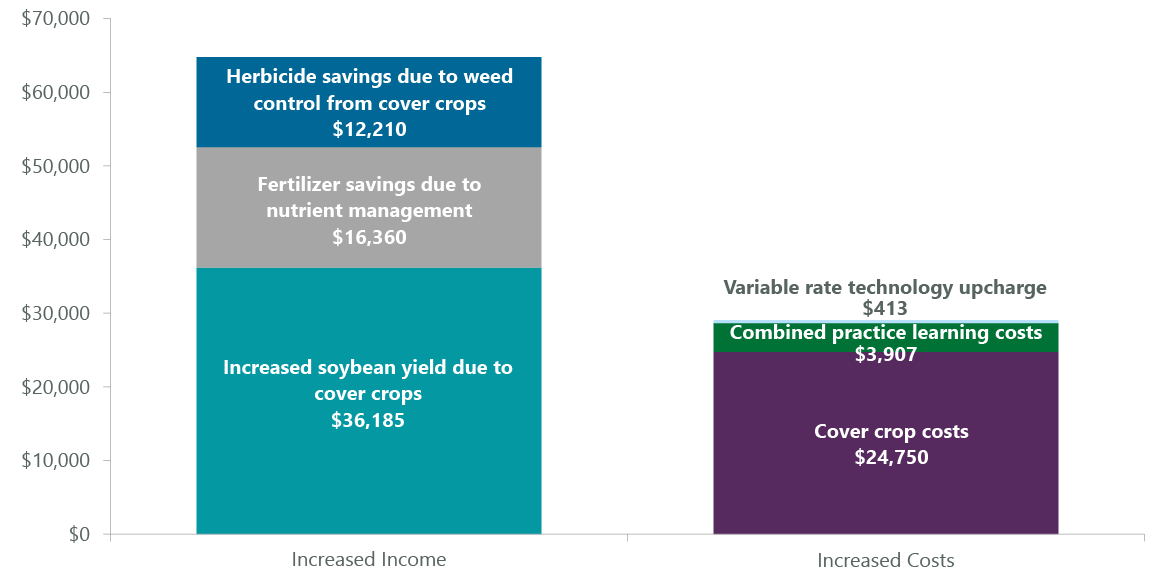

What sort of success is the concept of regenerative agriculture having among food companies? Large food producers such as PepsiCo, Nestle, General Mills and McCormick have all indicated regenerative farming is an increasing area of focus. In many cases this requires companies educating individual smallholder farmers on these practices: while there can be some short-term disincentives for farmers such as sacrificing crop yield as some soil lies fallow, regenerative farming is in farmers’ economic interests as it leads to more sustained yields over time. Case studies also suggest there are economic benefits to adopting regenerative agriculture practices for individual farms (Exhibit 6).

Exhibit 6: Economic Effects of Regenerative Farming Case Study

Source: Farmland Information Center Soil Health Case Studies. Shows economic effects of adopting cover crop and nutrient management practices on 1,650 acres of corn and soybean farmland in Livingston, IL. Published July 30, 2019.

Also, along with the question of defining and educating on the practice, certifying a regenerative agriculture supply chain presents another challenge, although A Greener World, which also offers animal welfare, grass-fed, and non-GMO welfare certifications, has developed one.

Reminiscent of the adoption of organic food, food companies using regenerative agriculture practices tend to be niche brands producing experimental product lines. Some, however, such as Annie’s Homegrown, owned by General Mills, or Applegate Farms, a natural and organic meat company owned by Hormel Foods, have a larger footprint, increasing the chance their products are in the grocery store and the potential impact their practices can have.

Annie’s has developed a self-assessment tool for farmers that can be used both as an information gathering tool and as an educational resource for farmers. The tool distinguishes crop acres and livestock acres and rates practices such as pest management, minimization of tillage, plant diversity, nutrient stewardship and integrating planned livestock grazing into cropping systems while at the same time furnishing related educational resources.

General Mills also has pilot programs intended to advance toward a goal of practicing regenerative agriculture on one million acres of farmland by 2030. These programs, launched in 2019 and 2020, provide farmers with practical tools to implement regenerative agriculture and include one-on-one coaching, three years of technical assistance, customized plans for implementation, soil health testing, farmer networking communities, and biodiversity and economic assessments to demonstrate impact on outcomes over time, according to the company. The projects include 45 oat growers across North Dakota, Saskatchewan and Manitoba; 24 wheat growers in the Southern Plains of Kansas’ Cheney Reservoir watershed area; and three dairy farms in Western Michigan.9

Chipping Away at Carbon Emissions

Similarly, PepsiCo looks to extend regenerative farming through its Positive Agriculture program, launched in 2021. It is seeking to spread regenerative farming practices across seven million acres, or roughly its entire agricultural footprint, through partnering with the growers behind products like Lay’s potato chips, Quaker oats and Tropicana orange juice. In one project, PepsiCo is partnering with British clean-tech firm CCm Technologies to turn potato waste into fertilizer. Using CCm Technologies’ carbon capture technology, potato peelings left over from the production of Walkers potato chips will be transformed into low-carbon fertilizer and returned to farms across the U.K. where potatoes for its chips are grown. The company reports a promising trial of the fertilizer and is at work beginning wider production in 2021. At scale, it believes the fertilizer can reduce its potato-based carbon emissions by 70%.10

Agriculture Has a Growing Role in Reducing Transportation Emissions

There are other ways for farming to reduce its CO2 footprint, for example through turning manure into renewable natural gas (RNG) that emits 95% fewer greenhouse gases than conventional fossil fuels, according to the U.S. Department of Energy. One innovation is dairy biomethane, in which dairy manure serves as feedstock in anaerobic digesters, which capture, extract, clean and convert the methane in the manure to RNG, which can then be used as transportation fuel. A joint venture between Chevron and waste solutions provider Brightmark will seek to capture methane from dairy farms across the U.S. to create transportation fuel considered to be carbon negative on a lifecycle basis. The joint venture’s initial project with three farms in Western New York recently came online and at full capacity is expected to produce 187,000 MMBtus of RNG per year, enough to power 3,000 semi-trucks from San Francisco to New York. Similarly, BP and CleanBay Renewables are embarking on a partnership to turn poultry litter into RNG.

The refining industry is also increasingly investing in renewable diesel using feedstocks such as animal fats and used cooking oils, which displace diesel and lower carbon emissions from the transportation sector. Diamond Green Diesel, a joint venture between Valero Energy and Darling Ingredients, is the largest such company in the U.S.

A Taste of the Future

There are promising developments in regenerative agriculture that could help improve agriculture’s emissions profile and offer consumers and investors a way to have an impact through moving capital toward innovators and adopters in the field. At the same time, regenerative agriculture is clearly in the early stages, and there is a lot of work to be done to refine and scale up the practice. The same must be said for carbon capture, in particular as it applies to the food industry. While the growth of plant-based foods likely gives us the clearest taste of the future of agriculture as it evolves to cope with and battle climate change, advances and innovation by both advocacy groups and food companies are helping agriculture make a holistic shift toward resilience in a climate-threatened era.

Related Perspectives

ClearBridge Investments 2024 Stewardship Report

ClearBridge Investments' annual stewardship report highlights how active ownership benefits from ESG integration and how company engagements and proxy voting create value and drive positive change.

Read full article