Achieving ESG Goals with a Quality Approach to Value

Key Takeaways:

-

While a passive approach tends to sacrifice sustainability through indiscriminate exposure to high-emitting sectors, an active approach to value investing enables a dual purpose of generating excess returns while simultaneously satisfying ESG objectives.

-

Companies enabling the transition to electric vehicles and the development of alternative energy sources are excellent examples of companies with sustainability trends that are the growth drivers of the business.

-

As strong management teams focus on long-term planning, which requires prioritizing sustainability, it makes sense to actively seek out high-quality, high-return businesses run by teams that are prudent stewards of capital.

What is Net-Zero and Why is it Important?

There often seems to be the perception of an inherent alignment between ESG investing and growth stocks — technology-focused companies with small carbon footprints supporting ESG goals such as renewable energy. On the contrary, value stocks are viewed as resource-intensive heavy emitters. It is natural, therefore, to be concerned if the rotation into value jumpstarted by November 2020 vaccine announcements would mean performance or sustainability compromises for investors.

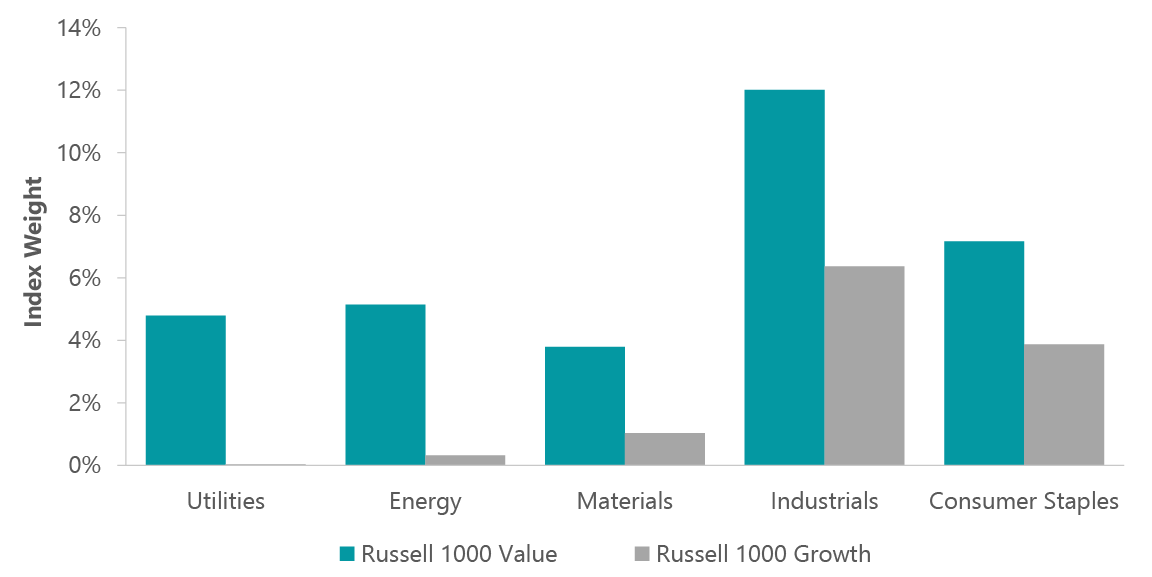

Looking at a large cap value benchmark like the Russell 1000 Value Index, the association of value

portfolios with old economy smokestack industries would seem to justify the conventional thinking. Taking emissions as one indicator of ESG characteristics, value is aligned with sectors with higher carbon intensity (Exhibit 1). Along these lines, underweights relative to a growth benchmark like the Russell 1000 Growth Index within information technology, consumer discretionary and communication services sectors, which are among the lowest-emitting sectors, are a further constraint to achieving sustainability.

Exhibit 1: Value/Growth Exposure to Top 5 Carbon-Emitting Sectors

Source: As of June 30, 2021. Source: FactSet, MSCI. Top five carbon-emitting sectors (tCO2e/$M) in the Russell 1000 Index.

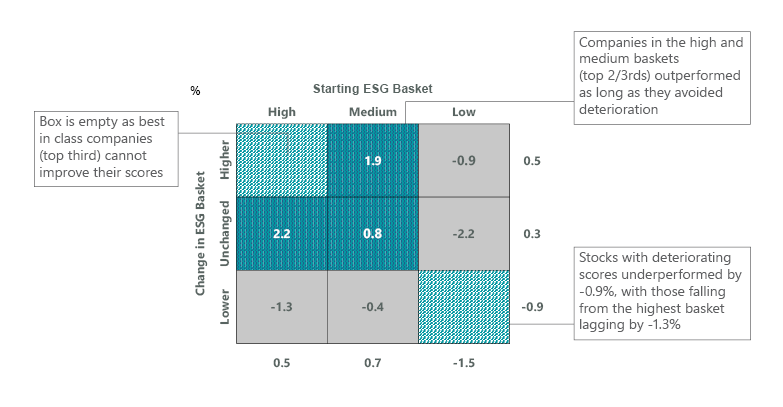

For a passive value portfolio this would be true. While a passive approach tends to sacrifice sustainability through indiscriminate exposure to high-emitting sectors, an active approach to value investing does not have to, especially if an actively managed value strategy is focused on competitively advantaged, high-quality businesses, enabling a dual purpose of generating excess returns while simultaneously satisfying ESG objectives. In addition, an approach that focuses on companies with strong ESG characteristics need not sacrifice returns, as analysis shows companies with better ESG ratings see superior returns as long as they avoid deterioration in their sustainability characteristics (Exhibit 2).

Exhibit 2: Relative Alpha of High/Medium/Low ESG Companies

Source: Credit Suisse. Based on directional change in company ESG rankings: companies in the high initial basket outperformed by 2.2% if ESG ranking remained the same; companies in the medium basket outperformed by 1.9% and 0.8% if they improved or maintained their ESG rankings, respectively. Annualized relative returns to S&P 500 over past 5 years; Change in ESG basket over the subsequent 12 months.

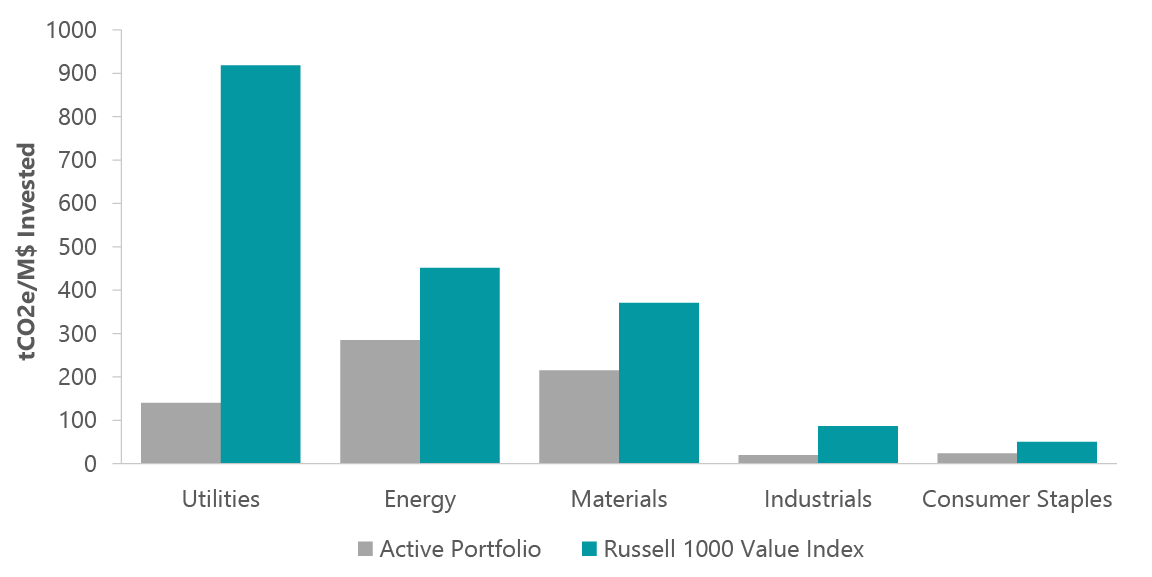

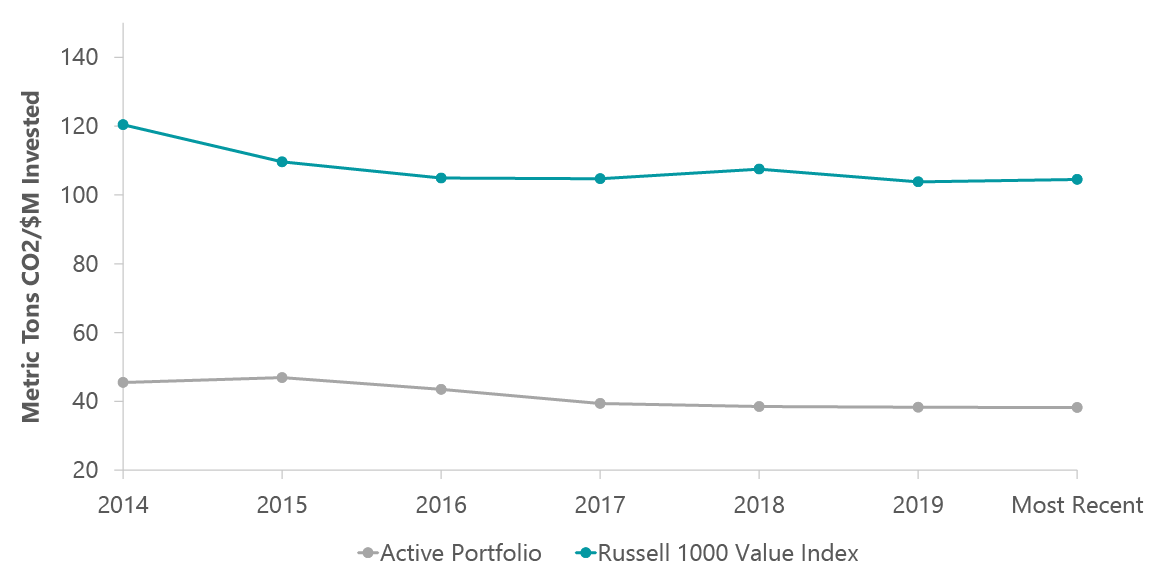

We expect greater returns from companies that are contributing to the transition to a more sustainable economy. By paying special attention to businesses with revenues driven by sustainability drivers and companies that are simply misunderstood or whose positive ESG attributes are overlooked, a quality approach to value investing may foretell strong ESG characteristics, overcoming a bias of non-ESG friendly investing. Lowering emissions is one way a quality-driven, active approach may gain on the benchmark (Exhibits 3 and 4).

Exhibit 3: Differentiation from Benchmark Supports Emissions Reduction Gains

Source: As of June 30, 2021. Source: MSCI. Holdings for ClearBridge Large Cap Value Strategy

Exhibit 4: Rail Covering More Distance Per Unit of Fuel

Source: As of June 30, 2021. Source: MSCI. Holdings for ClearBridge Large Cap Value Strategy.

Sustainability-Driven Revenues Are Maximizing Value

Regardless of the investment style, there are many companies benefiting from sustainability themes as they enable important societal goals. The need to identify and allocate capital toward these businesses argues for an active and differentiated approach to value investing, one that looks for strong, competitively advantaged franchises operating within stable to growing end markets, and invests in these at attractive valuations, rather than screening for cheap stocks or passively mimicking broad-based market indexes. Such an approach allows one to target companies with sustainability trends that are the growth drivers of the business. Companies enabling the transition to electric vehicles (EVs) and the development of alternative energy sources are excellent examples of these.

TE Connectivity Driving Electric Vehicle Innovation

TE Connectivity, which makes connectors for a wide range of uses, including automobiles, data centers and medical devices, stands out as an ESG leader. TE Connectivity’s products help enable environmentally friendly solutions like EVs, where they enjoy twice as much content per vehicle as compared to traditional internal combustion engine (ICE) vehicles, which reduces reliance on fossil fuels. They also enable socially valuable innovation such as advanced driver assist systems/autonomous vehicles, which should improve vehicular safety.

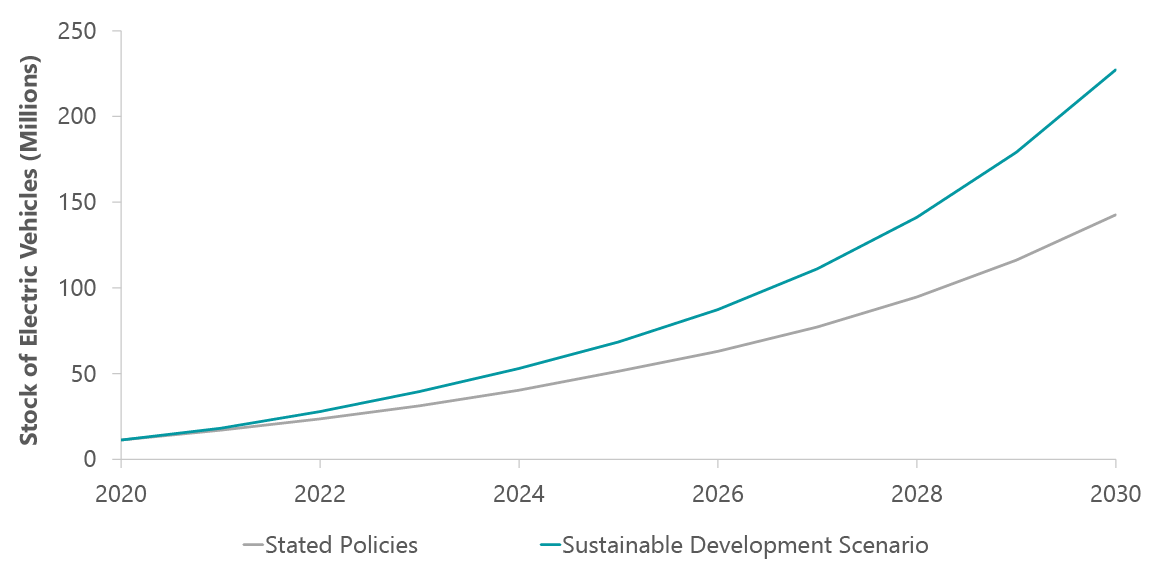

TE Connectivity’s revenue growth, then, is driven by increasing connector content in EVs, which should see strong growth in the coming years as the world adapts increasingly sustainable policies (Exhibit 5). Such policies should accelerate global EV stock -- the already growing number of EVs on the road.

The company has also reduced its energy use intensity by 30% and greenhouse gas intensity by 38% over the past decade. The manufacturing process for connectors is also very water intensive, but TE Connectivity has been able to reduce its water usage by 30% over the past decade as well. The company is best-in-class across all of these metrics.

Exhibit 5: Global EV Stock Under Stated Policies and Sustainable Development Scenarios

Source: International Energy Agency (IEA).

On the social front, in addition to enabling autonomous vehicles, TE Connectivity has been working to improve its commitment to responsible sourcing and to find alternatives to problematic materials such as cobalt for enablement of EVs, despite the fact that cobalt isn’t a directly sourced material for the company itself. The company does use gold extensively in its products, which can have negative environmental effects when mined, although it has committed to seeking more responsible mines for sourcing.

An important corollary to the adoption of EVs will be the increased demand for electricity. Broadly speaking, utilities are the biggest enablers of federal decarbonization policies through the continued retirement of coal power generation and its replacement with power from renewable sources; the hardening and expanding of transmission infrastructure; over time, the integration of hydrogen as a power source into existing natural gas distribution networks; and the build-out of EV infrastructure.

Sempra Energy Driving Alternative Energy Growth

To help meet the rising demand for clean energy, Sempra Energy, a California-based utility and infrastructure company, is directing capital toward developing hydrogen, renewable natural gas (RNG), fuel cells and carbon capture and storage. The company recently announced a Hydrogen Blending Demonstration Program, a joint R&D project of its two California subsidiary utilities, SoCalGas and SDG&E. The project is the first of its kind in California and aims to use surplus renewable electricity generated in the middle of the day to produce green hydrogen for subsequent injections into the natural gas stream for storage and use.

In addition to hydrogen, Sempra has directed capital toward RNG, fuel cells and carbon capture and storage. In 2019, SoCalGas set a goal to deliver 5% RNG sourced from organic waste to its utility customers by 2022 and 20% by 2030. Both utilities are seeking the regulatory approval of a program allowing their customers to purchase RNG as part of their natural gas service. Sempra has robust and highly visible capital plans to build out transmission and distribution infrastructure within its franchise territories in California and Texas to enable increasing use of renewables as mandated by state regulators. At the same time, natural gas will likely continue to remain an integral component of the energy transition and Sempra plays an important role in sustainably liquefying and transporting it both in the U.S. and Mexico.

A Differentiated View on Sustainability Opportunities

An active approach to value investing also enables a differentiated view of companies that are not given proper credit for their sustainability contributions. Contrary to the perception that value stocks are just old economy smokestack companies, many deploy innovative technologies for a more

sustainable future.

Deere Helping Sustainable Agriculture

Deere, in the industrials sector, manufactures agricultural, construction and forestry equipment. As an industrial equipment maker, Deere is easily lumped in with capital- and carbon-intensive industries, and can be easily overlooked by sustainability-focused investors. Yet the company has many environmentally friendly elements to its business for which we believe it is given less credit by ESG ratings agencies than it deserves.

Deere is a leader in precision agriculture, which applies new technologies in planting, spraying and irrigation tasks to improve yields while reducing the use of water and harmful pesticides and herbicides. Its AutoTrac steering system, for example, reads the soil and steers planters to nearly eliminate overlapping passes on the field, reducing fuel consumption and associated emissions, as well as seed and chemical use. Similarly, Deere has an artificial intelligence (AI)-based See & Spray technology that can dramatically reduce the use of chemicals. The See & Spray Select precision sprayer uses computer vision and AI to detect weeds as a farm sprayer passes over fallow ground and precisely sprays herbicides only where needed. It has a hit rate of 98%, similar to broadcast sprayers, which spray indiscriminately, yet it uses an average of 77% less herbicide than broadcast sprayers. In a meeting with Deere we learned of one field trial for cotton in which herbicide consumption costs declined to $25,000 compared to $250,000 the previous year. In addition, Deere’s ExactEmerge planter is designed to increase the accuracy of spacing, depth and population of seeds, improving farmers’ bottom line while benefiting the environment.

Similarly, Deere’s proprietary cold recycling technology used in road construction can reduce time and materials used and improve paved surface durability while lowering emissions and construction costs.

Air Products Innovating Major Green Hydrogen Projects

Air Products makes industrial gases for broad-based applications including health care, petrochemical and industrial use. As a leader in the global industrial gas industry, Air Products is easily overlooked as a potential contributor to a lower-carbon future.

At the same time, Air Products is the largest hydrogen producer globally. Among other applications, hydrogen is used for enhanced oil recovery and in refining. While these processes do emit CO2, using hydrogen enables avoiding two units of CO2 for each unit emitted, a nuanced yet important distinction only a sustainability-focused active manager may take the time to appreciate. In addition, Air Products has embarked on the largest green hydrogen project in the world. For its NEOM project in Saudi Arabia, Air Products will use 4GW of renewable power from solar, wind and storage to produce 650 tons of green hydrogen daily. The hydrogen will then be converted into green ammonia to safely transport it to serve global transportation markets.

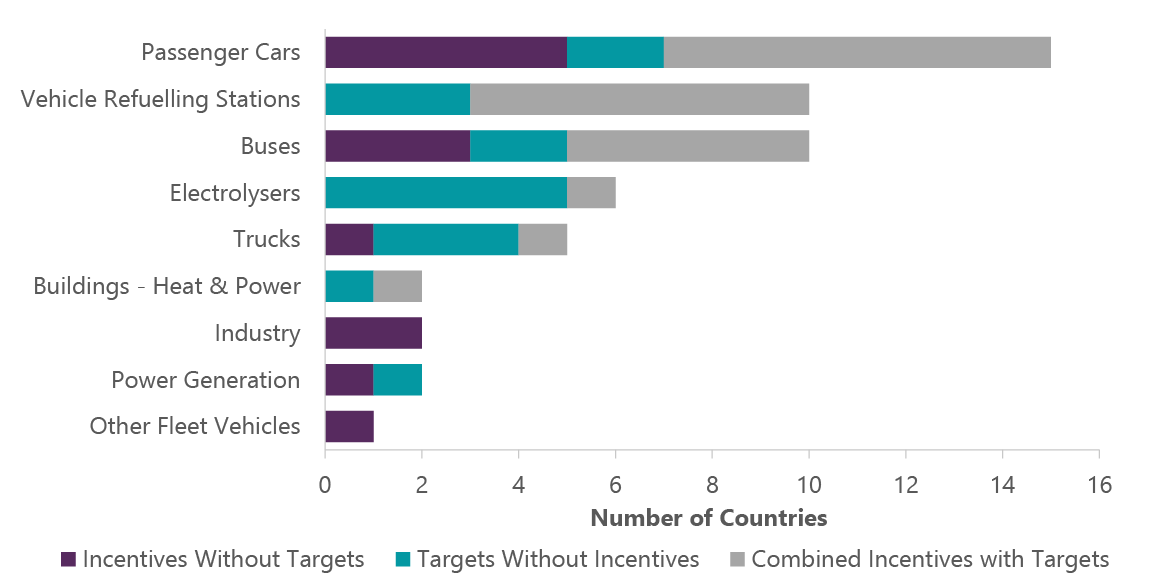

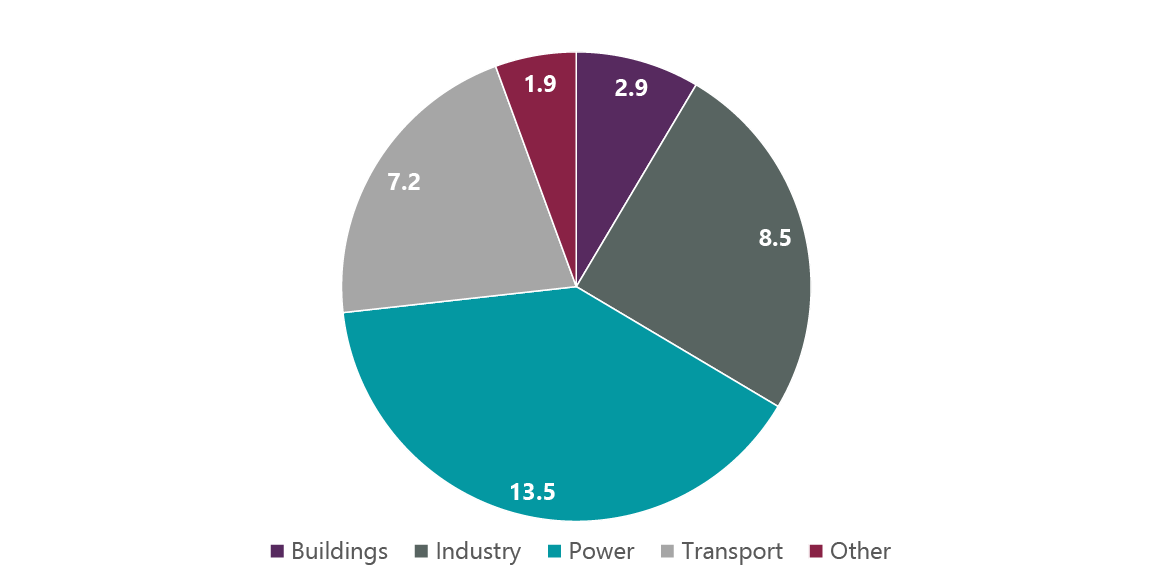

By being at the forefront of green hydrogen production, Air Products should further cement its leadership position in the ever-expanding world of hydrogen and the role it plays in the global economy. Exhibit 6 illustrates the growing global support for hydrogen technologies, tracking targets and incentives for development and production. At the same time, the company is addressing pressing societal goals of lowering transportation-derived emissions (Exhibit 7).

Exhibit 6: Current Policy Support for Hydrogen Deployment, 2018

Source: IEA. In the instance of passenger cars, five countries have incentives for hydrogen production, but not targets to shoot for, two have targets but don’t provide incentives while eight have both targets and incentives.

Exhibit 7: Total Global Emissions by Source 2020 (Gigatons)

Source: As of July 2021. Source: Net Zero by 2050: A Roadmap for the Global Energy Sector, IEA.

In 2021 the company also announced a multibillion-dollar plan in conjunction with the Government of Canada and the Province of Alberta to build a landmark new net-zero hydrogen energy complex that will make Edmonton, Alberta the center of western Canada’s hydrogen economy. The project will set the stage for Air Products to operate potentially the lowest carbon-intensity hydrogen network in

the world.

It All Begins with Management

High-quality, high-return businesses are generally run by strong management teams that are prudent stewards of capital. Company management is at the core of all decision making and firm activity, including where to invest and what areas to avoid. It is an appropriate starting place. Strong

management teams will focus on long-term planning, which will require prioritizing sustainability.

Good management teams will also manage companies in such a way that they have financial strength and flexibility to set ambitious yet achievable sustainability objectives. This is evident in the cases of TE Connectivity, Sempra Energy, Deere and Air Products, where strong balances sheets enable research and development in sustainability-related projects. A corollary is that companies struggling to keep their heads above water are less likely to have the resources to make sustainability gains.

Expense control, capital allocation and executive pay are relevant in weighing management quality. UnitedHealth Group offers a good case study of such quality characteristics serving as the foundation for both company growth and gains in overall health care affordability, quality and access — important social goals.

UnitedHealth Group Reducing Health Care Costs and Raising Quality

UnitedHealth Group is a leading diversified health care company that provides health benefits through its UnitedHealthcare segment and health services through its Optum division. UnitedHealthcare provides health care benefits to virtually all segments, including private enterprise (large corporate, small and medium-size businesses, individuals) and federal and state government (Medicare and Medicaid). The company benefits from its leading positions nationally and in local markets as well as from its diverse product offering. Its Optum division includes a range of fairly fast-growing businesses including pharmacy benefit management, site-of-care physician network and health care technology and consulting services.

UnitedHealth is part of the solution to high health care spending in the U.S., with an immense capability and investment in care management to jointly reduce health care system costs while raising quality and member health. This is particularly evident in UnitedHealth’s government businesses, where it has proven to deliver better health outcomes at lower costs in its managed Medicare and Medicaid businesses.

UnitedHealth’s quality management team and company as a whole are exemplary in their ability to be forward thinking in their vision for the health care system. Management then strategically builds capabilities ahead of its goals for the health care system, which then drives the system toward management’s vision. Examples include:

- Home care capabilities in Medicare

- Integration of prescription drug management back into health benefits by owning their own pharmacy benefit managers at scale

- Lower health care costs and improved outcomes by owning and operating primary care clinics and outpatient surgery centers

The management team is also excellent at capital allocation, for example in creating Optum through a successfully executed series of acquisitions in combination with organic efforts. It is also keenly focused on management development and succession.

UnitedHealth maintains a strong balance sheet with low leverage and delivers consistently strong growth, generating significant free cash flows.

UnitedHealth’s ability to reduce health care costs while raising quality and member health are relevant ESG considerations that reflect the quality of its management team and position the company for long-term success. A valuation-sensitive investor with an active position in UnitedHealth would do well in achieving both return goals and ESG objectives.

Conclusion

An active value investing approach that focuses on durable and resilient franchises operating in stable to growing end markets trading at attractive valuations, rather than tracking a broad-based benchmark or screening for cheap stocks, is advantaged in identifying and investing in companies with strong ESG profiles. Not only are these businesses best-in-class from a fundamentals standpoint, they are also typically the leaders in areas of sustainability. As the cases discussed here demonstrate, there is ample opportunity in the value universe to find such companies where sustainability will drive returns, and where returns will further the world’s efforts to improve sustainability.

Related Perspectives

Global Growth Strategy May Commentary

Global equities delivered broad gains in May as a potential détente in U.S. trade policy and the tailwinds of policy stimulus outside the U.S. lifted shares. North America was the only region to outperform the 5.14% return in local currency of the benchmark MSCI All Country World Index.

Read full article