War Accelerates Secular Policy Shifts Across Europe

Key Takeaways

- Russia’s invasion of Ukraine has unified Europe on political, economic and defense policies as evidenced by recent agreements over economic sanctions and military aid.

- European countries now realise they will need greater stimulus and investment in renewable energy to obtain energy security.

- The invasion has accelerated many of the long-term, resource-intensive transitions that support our pro-cyclical outlook and positioning.

Economic Sanctions Cause Commodities to Skyrocket

Russia’s invasion of Ukraine last month ended the decades-long peace in Europe and injected a new source of uncertainty into global markets already grappling with inflation, tightening monetary policies and global supply chain disruptions. Strong Ukrainian opposition has extended the conflict beyond the short campaign many expected, affording a level of market stabilisation and time for investors to reassess the outlook for European equity markets.

The imposition of economic and financial sanctions on Russia has significantly reduced the contribution of the world’s 11th-largest economy and one of the world’s largest raw material producers. The loss of Russia’s 4.3 million barrels per day of oil to fuel the global economic recovery sent prices skyrocketing, with oil crossing the $100 per barrel threshold for the first time since 2014 and reaching a high of $130 per barrel in early March before retreating. Likewise, the price for the precious metal palladium, of which Russia is the world’s largest supplier, has climbed to its highest level on record as already low inventories are at further risk of depletion. With Russia and Ukraine being among the top five global wheat exporters, the war has spurred a rise in wheat prices that pose societal risks in many emerging market countries.

In addition to greater inflationary pressures, the war is likely to further complicate global supply chain disruptions. The lack of access to raw materials and precious metals due to sanctions will undoubtably result in delayed manufacturing as companies are forced to find alternative sources of materials. The combination of additional global supply chain disruptions, greater inflationary pressures and loss of consumer income due to increased energy costs has increased the probability of a near-term recession in Europe. Should a recession or stagflation develop and spread globally, the tightening regimes of major central banks would likely moderate. Despite these uncertainties, Europe’s clear recognition of the importance of security independence has created strong catalysts that we believe could bolster the region’s long-term attractiveness to investors.

Europeans Unify in Pivoting Economic Policy

The conflict has spurred Europe to reassess its economic policies. Whereas policymakers have spent the last 20 years applying austerity measures in the pursuit of prosperity, the outbreak of war has forced a realignment of priorities. Countries have recognised that safeguarding their national sovereignty requires developing a more unified approach to economic policy, further military spending and greater energy independence. Recent agreements over economic sanctions, military aid and renewed calls for debt mutualisation among EU member states have demonstrated Europe’s willingness to unify on political, economic and security policies. However, unity alone is not enough to achieve these objectives. European countries have realised they will need greater stimulus, private sector financing and investment in industries critical to ensuring their political and energy security.

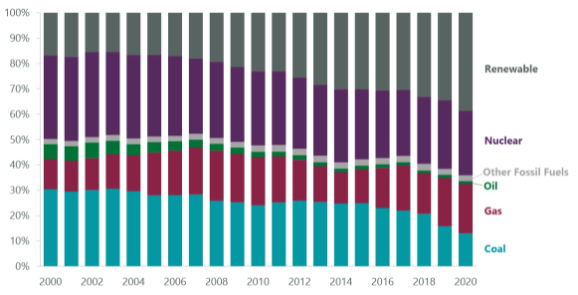

Exhibit 1: EU Energy Generation by Resource

As of Dec. 31, 2020. Source: Bloomberg.

The potential sanctioning of Russian oil and natural gas laid bare the European continent’s reliance on hydrocarbon imports from an authoritarian regime and hastened the urgency of accelerating the energy transition to renewables. Europe’s need to achieve relative energy independence and security will require significant investment across the physical foundations of its economy. Policymakers have responded with remarkable speed, with the EU announcing its REPowerEU framework in early March; the framework is intended to make Europe completely independent of Russian fossil fuels before 2030 and reduce the demand for Russian natural gas by two-thirds by the end of 2022. Several European countries have already reversed the course of their energy policy to reconsider using nuclear power as a crucial component of their energy security, with Germany slowing the shutdowns of its existing nuclear plants and France committing to building six new ones.

To achieve full energy independence and security, both the EU and individual countries must substantially increase their investment in renewable energy, energy storage and the infrastructure to support an updated electrical grid. Financing for these projects will need to be shared by government spending and private sector lending. Europe’s experience and early transition to renewable energy has provided its banks with ample experience in funding large-scale solar, wind, hydro and renewable energy projects, which should help provide innovators and developers with greater access to capital. This effort, along with the contributions of local and multinational companies across the utilities, industrials, materials and technology sectors and legacy energy companies remaking their business models for a net-zero future, will be critical to obtaining true energy independence.

Despite Conflict, Europe Remains Attractive

Despite the myriad uncertainties as well as severe humanitarian and financial tolls brought on by the Russian invasion of Ukraine, we believe European equities remain the most compelling opportunity set globally. We continue to hold strong convictions in European financials and the crucial role they will play in helping Europe facilitate investments in industries needed to achieve greater national security and we believe them to be fundamentally well-positioned to withstand a recession that may result from a prolonged conflict. The invasion has also accelerated many of the secular trends we are following, including the global energy transition, electrification and a reversion from focusing on digital solutions to physical products. These will be long-term, resource-intensive transitions that support our pro-cyclical outlook and positioning.

Related Perspectives

China Emerging as Global Biotechnology Player

Evolving from its fast follower approach, an expanding number of Chinese biotech companies are licensing new compounds to multinational pharmaceutical firms.

Read full article