U.S. Equity Outlook: Markets Gird for Reduced Liquidity

Key Takeaways

- The pace at which liquidity is removed from the economy, via the tapering of quantitative easing and an eventual hike in short-term interest rates, is the key factor we are monitoring to gauge the trajectory of stocks in 2022.

- Mixed market breadth is a concern. We believe small cap participation, which despite recent improvement has lagged for some time, is necessary for the broader market to continue to move higher in a meaningful way.

- Value will likely be the dominant trade as the economy accelerates over the next three or four months, but on a one-year basis, we advocate a more balanced approach as growth stocks should continue to do well.

Cyclicals Best Positioned to Weather Higher Inflation

U.S. equity markets are on track to deliver a third-straight year of double-digit returns, boosted by ample monetary and fiscal support, which has been offsetting the negative economic impacts of the COVID-19 pandemic. As we close the books on 2021, the recovery has progressed to the point where the Federal Reserve is poised to begin tapering its quantitative easing program, which will reduce the liquidity available to the financial system. Liquidity is one of several key factors we are monitoring closely to gauge the likely trajectory of stocks in 2022. While the current bull market seems poised to continue, we expect volatility to increase as the year progresses, which could temper equity performance.

Inflation will continue to be a primary risk to equities. As 2021 began, consensus inflation expectations were only +2%, but with the October Consumer Price Index coming in at +6.2%, the market is confronting real inflation risks for the first time in years, decades even. Fragmented global supply chains, negatively impacted by reductions in activity related to COVID-19, have struggled to meet resurgent demand, driving inflation for many goods that remain in short supply. That said, inflation has broadened out over the last six months from areas like used cars to other goods and services. Notably, wage inflation has also spiked and could be more persistent than is currently expected, forcing the Federal Reserve to act more aggressively.

So how are we thinking about inflation as investors? In general, we prefer companies with strong pricing power or expense passthroughs and lower labor intensity to mitigate the risk of a persistent inflationary environment. Higher inflation should favour commodity-driven sectors like energy and basic materials and hurt labor-intensive areas like consumer discretionary.

Energy is the best-performing sector year to date, and while commodities remain strong, we don't expect to return to a 2014-like commodity super cycle. However, we do see the potential for a mini upcycle in commodity stocks as we enter 2022. Beyond energy, sectors that have traditionally done well during inflationary periods include financials, industrials and consumer durables. Areas of the market less able to pass on costs to consumers — defensive sectors like food and certain areas of retail and utilities — have performed the worst during these periods.

With respect to inflation, what’s interesting is how technology stocks have fared. Tech companies generally have very high gross margins, which provide a lot of flexibility in terms of absorbing cost pressures. Traditionally, they have also done a good job of raising prices, as many technology contracts have built-in price escalators. In our view, technology sits in the middle of the pack in terms of inflation risks.

Monitoring Liquidity and Market Breadth

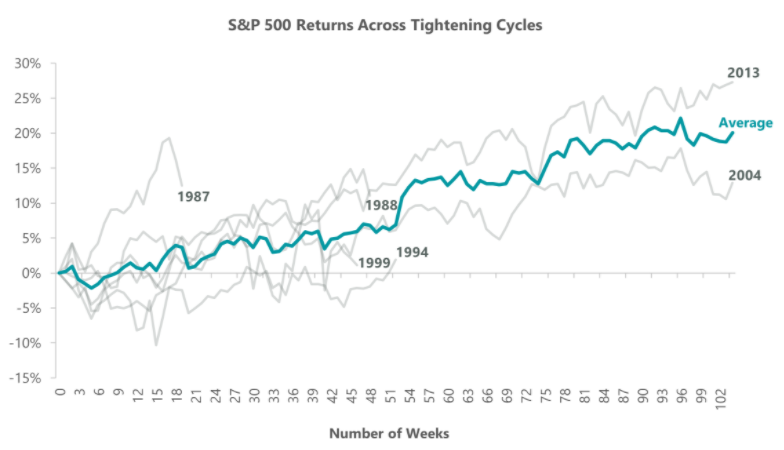

A bigger concern for us is the gradual removal of liquidity from the financial system. Liquidity is a primary determinant of equity performance: it’s what causes bull and bear markets. The market will transition from significant excess liquidity toward a more normal environment over the next 12–18 months. Tapering will remove some liquidity while, depending on inflation levels, the Fed will likely begin to raise interest rates. Fed Chairman Powell’s latest comments indicate the first increase in the federal-funds rate could come in the middle of next year, well earlier than the market was discounting just months ago. Both tapering and raising short-term rates would remove liquidity from the system at a time when valuations are near historic highs. A liquidity event could create short-term headwinds, but stocks have shown the ability to rebound after the initiation of a tightening regime (Exhibit 1).

Exhibit 1: Fed Liftoff, Brief Pullbacks

Data as of June 18, 2021, latest available as of Sept. 30, 2021. Source: FactSet, S&P Global

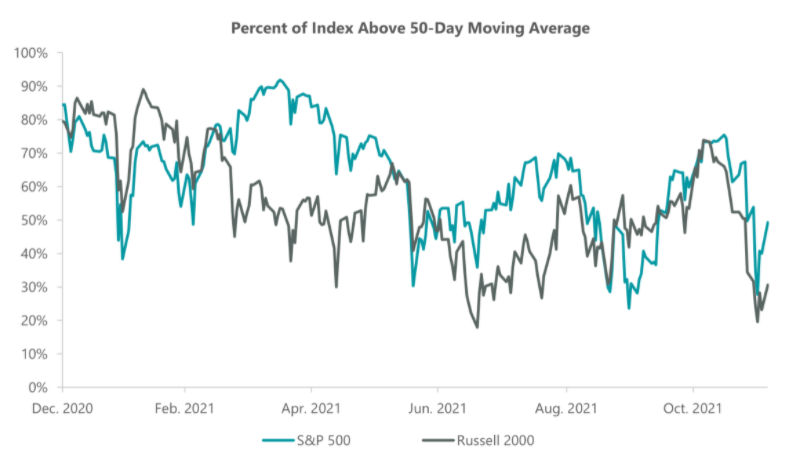

Market breadth is another key indicator of the health of equities. When the market averages are up strongly, like we have seen the last two years, the market appears very healthy. But broad market measures like the S&P 500 Index don't really tell investors what is going on underneath the surface. So we look at market breadth, which is like taking an X-ray on the internals of the market. Good indicators of market breadth include operating company advance-decline lines, the number of companies trading above their various moving averages, and the number of companies making new highs. All of these statistics provide insights into the percentage of companies actually participating in an advance; the more there are, the healthier it is for the market and the more likely it signals further market gains. The opposite is also true: when averages are high but with narrow participation, we view that as unsustainable and vulnerable to decline. In today’s market, we view market breadth as mixed but leaning positive (Exhibit 2). We continue to watch small cap stocks as we believe their participation is necessary for the broader markets to keep moving higher.

Exhibit 2: Small Cap Participation Key to Sustained Gains

Data as of Dec. 6, 2021. Source: FactSet.

Fundamentals Favour Value, but Don’t Count Out Growth

After a brief run for value early in the year, growth stocks have retaken market leadership. Divergent performance between growth and value has widened out again similar to the early days of the pandemic. In fact, the growth/value environment has become so extreme that the MSCI World Value Index, which measures the performance of value stocks globally, recently hit its lowest point in 50 years versus its growth counterpart. Despite a short-lived rebound in value, we remain in an imbalanced market with respect to value versus growth.

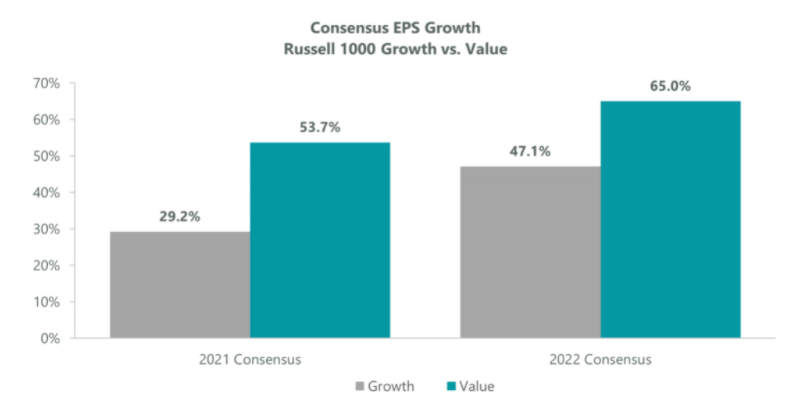

Some of the highest-multiple growth stocks suffered the sharpest losses in the recent Omicron-driven selloff, and we expect higher inflation and accelerating economic growth could hand the mantle back to value in the first half of 2022. Thus, in the near term, we believe it makes sense to favour certain types of value stocks as this is where we see the greatest balance between earnings growth (Exhibit 3) and valuation. It’s important to make a distinction between value and cyclical stocks. Value is a combination of cyclical industries and defensive industries and, at this point in the cycle, we would favour cyclicals over defensives.

Exhibit 3: Fundamentals Favour Value Stocks

Data as of Sept. 30, 2021. Source: FactSet.

As we saw last year, a cyclical rally does not necessarily penalize growth companies. Over the next three or four months, value will likely be the dominant trade, but on a one-year basis, we advocate a more balanced approach as growth should continue to do well. Technology is often used as a proxy for growth and high-quality technology companies have been debunking one of the key misperceptions about growth stocks and rising interest rates. While the highest-valued tech stocks tend to sell off when rate hikes appear imminent, tech companies that actually come through with their forecast growth, or better yet exceed it, can continue to perform well despite an increase in interest rates.

Conclusion

As we enter 2022, we believe investors should stay the course in equities. We continue to recommend a balanced approach to the markets, including both growth and value stocks and with an emphasis on quality companies. Market breadth remains generally healthy with the participation of small caps a key indicator to watch. We believe the path of inflation going forward will be the key driver of stock performance in the year ahead, especially in terms of its impacts on the rate of tapering and the pace with which liquidity is removed from the financial system. While markets are poised to rally into the new year, we believe more caution will be warranted as we enter the second half of the year if we begin to see inventory imbalances and a less accommodative liquidity environment.

Related Perspectives

The Long View: It's All About Perspective

The ClearBridge Recession Risk Dashboard improved to an overall green signal this month with three underlying indicator improvements, supporting our view of continued economic normalisation.

Read full article