The Power of Infrastructure: Stability and Growth in Volatile Markets

In times of economic uncertainty and market volatility, investors turn to strategies that offer a balance of stability and growth. One asset class that is capturing increasing attention is global listed infrastructure. These companies are publicly traded on stock exchanges worldwide and offer a unique opportunity to invest in essential assets that underpin society’s functioning.

ClearBridge Investments has a specialist team that focuses exclusively on infrastructure investing and manages the ClearBridge Global Infrastructure Value Strategy. This article explores the merits of this Strategy, examining its risk-return profile compared to global equities and other asset classes, and delves into its resilience during recessions and inflationary periods.

A Smooth Path to Growth

The Global Infrastructure Value Strategy has demonstrated its expertise since its inception in August 2006, outperforming global equities while maintaining lower volatility (Exhibit 1). The Strategy seeks to achieve similar long-term returns as global equities but follows a smoother trajectory, making it an attractive option for risk-conscious investors.

Exhibit 1: Infrastructure Has Delivered Higher Returns with Lower Volatility than Traditional Equities

Since inception of the ClearBridge Global Infrastructure Value Strategy (31 August 2006 to 30 June 2023). Returns in AUD. Global Equities: MSCI AC World Index; Global REITS: FTSE EPRA/NAREIT Global Index; Global Bond: Bloomberg Global Aggregate Index; Global Corporate Bond: Bloomberg Aggregate Corporate Index. Source: ClearBridge Investments, eVestment.

Defensive Exposure During Recessions

During economic downturns and recessions, investors often flock to defensive assets to protect their wealth. To this end, the Global Infrastructure Value Strategy’s underlying assets deliver consistent cash flows throughout the economic cycle. These essential service infrastructure assets (such as regulated utilities or user-pays assets like airports and toll roads) are underpinned by either regulation or long-term contracts, and they have proven to be resilient even in times of economic stress.

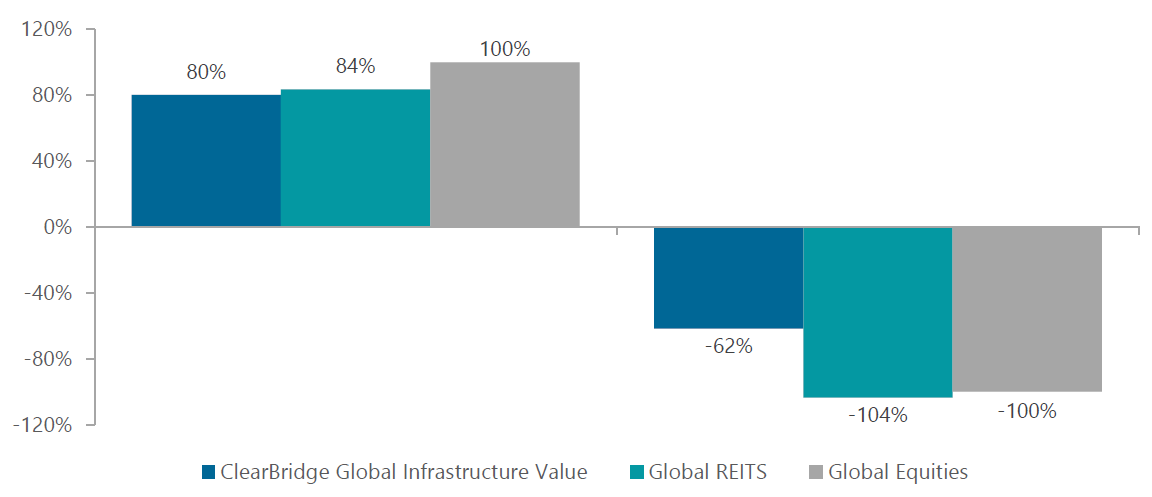

Exhibit 2: Infrastructure’s Upside/Downside Capture Versus REITs and Global Equities

Since inception of the ClearBridge Global Infrastructure Value Strategy (31 August 2006 to 30 June 2023). Global REITS: FTSE EPRA/NAREIT Global Index; Global Equities: MSCI AC World Index. Source: ClearBridge Investments, eVestment.

The defensive nature of infrastructure assets enables the Strategy to outperform broader equities in more defensive markets (Exhibit 2), as exhibited by the Strategy’s low downside capture. Infrastructure’s stability of cash flows — a key to its defensive behaviour — helps weather economic headwinds, acting as a shield against market turbulence and delivering reliable performance to investors when they need it most.

Infrastructure in High-Inflation Environments

Infrastructure cash flows also exhibit robustness in environments of rising inflation. Many of the Strategy’s holdings have revenues with direct or indirect links to inflation, which helps to offset the eroding effects of rising prices. This pass-through of inflation is unique to infrastructure assets (Exhibit 3) and is important for two reasons. Firstly, we expect inflation to ultimately settle higher on a look forward basis than investors got accustomed to over the previous decade, so investors should build in additional inflation protection into their portfolios. Secondly, this pass-through of inflation can lag anywhere from a few months to a few years, which means the impact to cash flows from the higher inflation of 2022 has yet to be fully reflected in company results and market expectations.

Exhibit 3: Infrastructure is Unique as an Inflation Hedge

|

Infrastructure |

REITs |

Commodities |

|

|

Pricing Mechanism |

Regulation Concession |

Supply & Demand |

Supply & Demand |

|

Market Structure |

Monopoly/Oligopoly |

Competitive |

Competitive |

|

Demand/Volume Volatility |

Low |

Moderate |

High |

Source: ClearBridge Investments.

Flexibility and Resilience

The Strategy’s uniqueness lies in its benchmark-unaware approach to portfolio construction. This adaptability allows the Strategy to tilt toward more defensive regulated utility stocks in challenging economic environments. By the same token, it can pivot toward more GDP-sensitive user-pays infrastructure, such as airports, during times of strong economic growth and recovery.

By embracing this flexible approach, the Strategy capitalises on the best opportunities across various market conditions, delivering an asymmetrical return profile. This means capturing more upside potential while providing solid downside protection, a combination that has historically resulted in attractive total returns for Australian investors compared to broader equities and REITs.

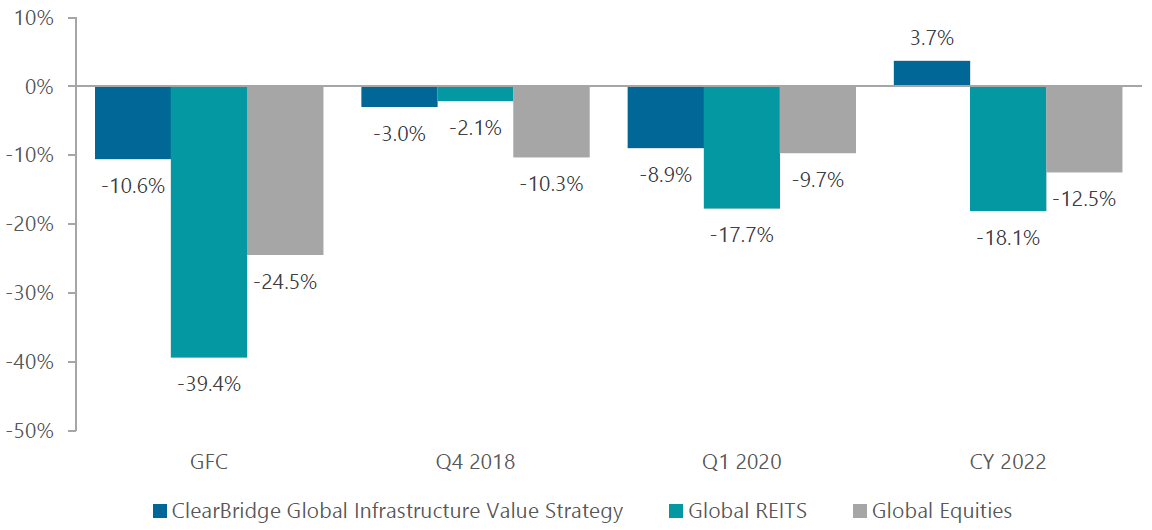

The Strategy’s resilience is not just theoretical; it has proven its fortitude in turbulent times. During the Global Financial Crisis (GFC) from September 2008 to February 2009, the Strategy’s performance demonstrated its ability to weather volatile markets and provide investors with a sense of security during turbulent periods (Exhibit 4).

Exhibit 4: Infrastructure Offers Greater Stability in Volatile Markets (AUD)

Source: ClearBridge Investments, eVestment, Global REITS: FTSE EPRA/NAREIT Global, Global Equities: MSCI AC World.

ClearBridge’s Global Infrastructure Value Strategy offers investors a powerful solution to navigate the uncertainties of today's global markets. With its unique blend of stability and growth, the Strategy has outperformed global equities since its inception, while maintaining lower volatility. Moreover, its defensive exposure during recessions and performance in high-inflation environments showcase its versatility and resilience.

As investors increasingly seek strategies that can withstand market volatility and capitalise on growth opportunities, the Global Infrastructure Value Strategy represents a compelling choice. It focuses on regulated or contracted infrastructure assets and employs a benchmark-unaware approach, enabling its specialist investment team to adapt to ever-changing market conditions. This adaptability provides a smoother path to growth and enhances investor confidence, especially during times of uncertainty.

Related Perspectives

Global Infrastructure Income Strategy May Commentary

Tariffs are unlikely to have a meaningful impact on utility earnings given they service domestic catchments with electricity, gas and water, and are not directly exposed to international trade.

Read full article