Infrastructure Provides A Differentiated Source Of Income

With government bond yields near record lows, and in many cases delivering negative real yields, investors have had to look to additional asset classes to meet their income needs.

In this environment, investors need to build their portfolios to deliver income from a variety of sources to ensure their income stream is sustainable over time.

Listed infrastructure is a popular income solution for many. This is due to:

-

a long-term track record of consistently delivering attractive yield

-

a growing income stream, linked to the asset base of these companies rather than the business cycle

-

overall portfolio diversification benefits of lower correlation to other equity asset classes

Source

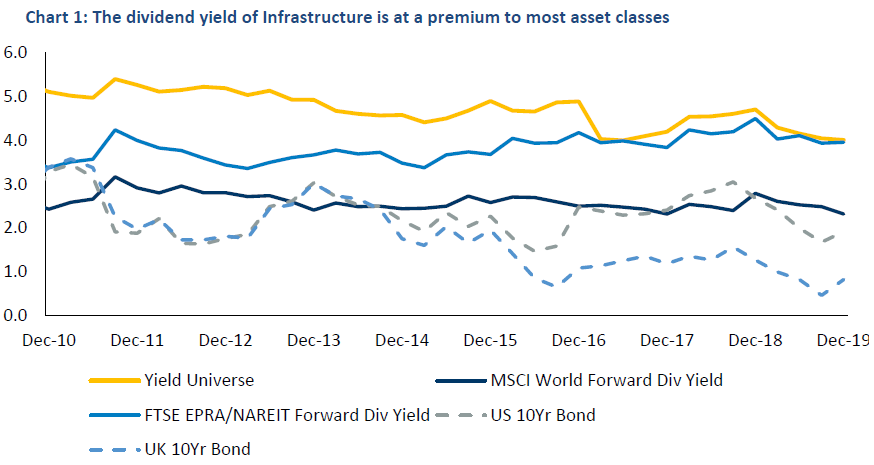

As at 31 December 2019. RARE Yield Universe – Yield_Universe, monthly since June 2010. MSCI World Forward Dividend Yield , MXWO Bloomberg, FTSE EPRA/NAREIT Global Fwd Div Yield, FENHG Bloomberg, US Benchmark Bond – 10 year – Yield, Factset Research Systems, United Kingdom Benchmark Bond – 10 Year - Yield, Factset Research Systems, Germany Benchmark Bond – 10 year – Yield, Factset Research Systems. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situations or needs of investors

Chart 1 illustrates that global infrastructure has delivered to investors a significantly higher yield than global equities and global bonds and a yield in line with global listed property.

Investors must also consider whether their allocations meet their investment objectives today, as well as the potential to continue meeting those objectives into the future.

In this way, infrastructure has an edge as a long-term income solution. Revenues are generally linked to the asset base of these companies, rather than to the ups and downs of economic activity (as is the case with traditional equities and REITs).

As a result, the quality of a company’s assets and a detailed assessment of the regulation or contracts governing them needs to be front and centre to a portfolio manager’s process. This is what delivers stable cash flow and greater capital stability. As demonstrated in the chart below, a growing asset base drives growth in dividend yields.

Source

RARE calculations as at 30 June 2019

RARE Infrastructure Income Strategy.

Lastly, Australian investors have chosen listed infrastructure due to the strong portfolio diversification benefits. RARE’s Infrastructure Income Fund has, since 2012, delivered strong total returns with a correlation of monthly returns of only 0.49 to Australian equities and 0.58 to global equities.

The Bottom Line

Investors have had to look beyond traditional sources of income; while both global equities and REITs have the ability to provide attractive yields relative to bonds, both have revenues and ultimately dividends linked to economic activity.

Listed infrastructure has an important role to play in investors’ portfolios, providing a differentiated source of attractive and growing income linked to the asset base, whilst delivering total returns with a lower corelation to domestic equities.

Related Perspectives

Structural Tailwinds Make Utilities High Income and High Growth

Q2 2024 Infrastructure Income Strategy Commentary: Growing power demand from AI data centres is a positive for both utilities and energy infrastructure.

Read full article