Income from global portfolio diversification

Australian investors, like many around the world, have a pronounced home bias when investing - this is particularly true when building retirement or income orientated portfolios.

While this is understandable given our familiarity with local companies and the attraction of franking credits, it may compromise a portfolio’s ability to achieve its long term objectives.

Firstly, investors miss out on a world of potential opportunities. Australia represents only around 2% of the global share market capitalisation. A larger global allocation vastly increases the flexibility available for investors to generate appropriate levels of total return. It also increases opportunities for investors to meet their investment objectives over the long term and may reduce the risk of investors outliving their capital.

Secondly, a heavy reliance on Australian exposure to deliver income risks incurring a shortfall when investors can least afford it. The adage “don’t put all your eggs in one basket” comes to mind. When close to, or in, retirement, the ability to generate additional income in the event of an unexpected shortfall (such as a sharp drop in interest rates, a dividend cut or a change in tax policy) is more limited compared to the accumulation phase (where time is on the investor's side). Consequently, it is prudent for investors to construct a portfolio with as many differentiated sources of income as possible.

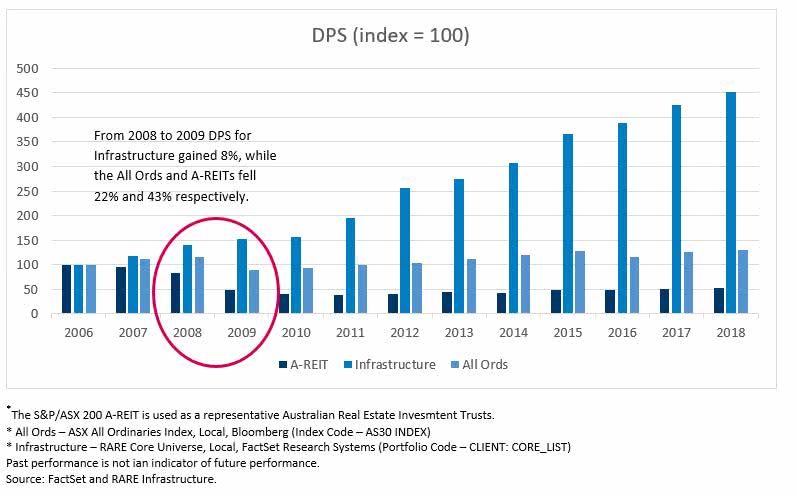

As demonstrated in the chart below, dividends fell sharply across Australian equities during the Global Financial Crisis with traditional sources of equity income such as Financials, Energy or AREITs, significantly cutting their returns. Conversely, dividends from global listed infrastructure steadily rose. Infrastructure’s ability to generate income is determined by the regulation and contractual structures in place and is much more closely linked to the growth in the underlying assets than it is to the strength or weakness of the economy. For investors, this is what delivers stable cash flow and greater capital stability.

The RARE Infrastructure Income Fund seeks to deliver reliable, steady income targeting 5% pa (net of withholding tax) by investing in global listed infrastructure while diversifying an investor’s portfolio across economic conditions, regulatory regimes and political environments.

To learn more, listen to Nick Langley, Co-CEO/Co-CIO at RARE, talk about how investing in infrastructure can diversify your portfolio while generating reliable, stable income.

The quality of a company’s assets and the regulation or contracts that govern them is what delivers stable cash flow and greater capital stability. For investors, this provides excellent visibility for revenues and dividends, particularly as we enter into the later stages of the economic cycle.

Related Perspectives

Resilience with Upside in a Volatile Quarter

Q2 2025 Global Infrastructure Income Strategy Commentary

Listed infrastructure was resilient during the market volatility in April, strongly outperforming the broader market, and remained steady through May and June while equities recovered from the selloff.