AI Rally Buoys Global Growth Stocks

Q2 2025 Global Growth Strategy Commentary

Key Takeaways

- Improving sentiment over the global trade picture raised investor appetite for risk, spurring global growth equities to handily outperform value.

- The Strategy outperformed, boosted by solid contributions among our communication services, AI-indexed and consumer holdings and across the U.S., Europe Ex U.K. and emerging markets.

- We continued to actively reposition the portfolio, reducing exposure to higher U.S. dollar-weighted companies and redeploying the proceeds into more domestic businesses that can benefit from increasing fiscal stimulus.

Market Overview

Global equities maintained positive momentum in the second quarter as U.S. stocks staged a powerful rally following an initial tariff shock while Europe signalled progress on fiscal stimulus and reform measures as investment flows into the region increased. The benchmark MSCI All Country World Index (ACWI) advanced 6.1% in local currency, with Asia Ex Japan, emerging markets and Europe Ex U.K. outperforming, North America and Japan performing mostly in line with the benchmark while the United Kingdom underperformed.

Improving sentiment over global trade following President Trump’s early April Liberation Day U.S. tariff announcement raised investor appetite for risk, helping global growth stocks handily outperform their value counterparts.

The U.S. equity rebound was marked by a return to mega cap AI market leadership, with hyperscalers showing their commitment to high levels of AI-driven capex. Strategy holdings Microsoft and Meta Platforms outperformed the benchmark as both they and semiconductor companies, including holdings Nvidia and Broadcom, were boosted by solid earnings and renewed expectations of widespread AI adoption.

On a broad sector basis, the information technology (IT), communication services and industrials sectors led benchmark performance. U.S. gaming platform Roblox, in communication services, was the top contributor for the period, lifted by strong financial results, accelerating user engagement and strategic product developments led by breakout game “Grow a Garden.”

The ClearBridge Global Growth Strategy outperformed its benchmark for the quarter, boosted by solid contributions primarily in the U.S. as well as Europe Ex U.K. and emerging markets.

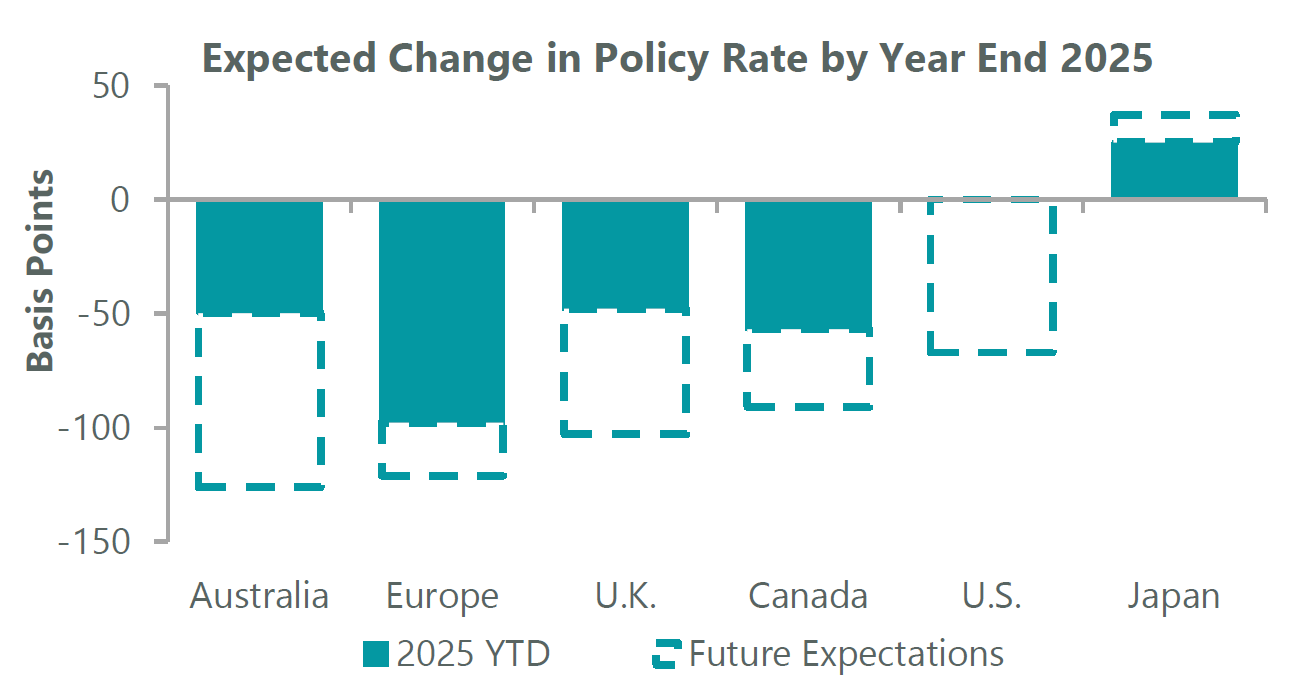

Global macro conditions were supportive. The U.S. saw steady job growth and mild inflation, leaving the door open to rate cuts from the Federal Reserve. Eurozone GDP expanded at a 2.5% annualised rate in the first quarter while inflation edged below the European Central Bank’s 2% target in May. This allowed the ECB to continue its monetary easing cycle with two rate cuts during the quarter, which brought its key deposit rate down to 2%. Compared to the U.S. federal-funds rate of 4.25%, financial conditions remain meaningfully more accommodative on the Continent (Exhibit 1).

Exhibit 1: Non-U.S. Central Banks Lead Monetary Easing

Note: Future expectations based on futures/OIS market pricing for mid-year 2025. As of 30 June 2025. Sources: Federal Reserve, ECB, BOE, BOC, BOJ, RBA, Bloomberg. There is no assurance that any estimate, projection or forecast will be realised.

These tailwinds, along with a greater commitment to fiscal spending led by Germany’s new coalition government, whose agenda is expected to include tax cuts and labour reforms, have made Europe a more attractive destination for investors. Japan continued a secular shift away from decades-long deflation and negative interest rates, as healthy wage growth and labour market imbalances drove inflation above 2% and government bond yields to 15-year highs.

Companies supporting the buildout of generative AI capabilities were among the Strategy’s top contributors, led by South Korean memory chip maker SK Hynix, semiconductor equipment maker Tokyo Electron and Broadcom, a leading U.S. developer of custom silicon chips for AI applications. Strong consumer discretionary results were led by Canadian discount retailer Dollarama and Latin America e-commerce platform MercadoLibre.

Financials were weak overall due to several insurance and exchange names underperforming. U.S. insurance broker Marsh & McLennan and Swiss commercial insurer Chubb slumped due to the unwind of the flight to quality trade that occurred in the first quarter along with concern around a softer insurance pricing environment. London Stock Exchange Group was also a detractor.

Portfolio Positioning

We continued to actively reposition the portfolio, initiating five new positions while closing 13 others, with many of the changes motivated by concerns over the U.S. economy and U.S. dollar. This led us to sell higher dollar-weighted companies at high prices, including U.S. off-price retailer TJX and Irish building materials supplier CRH, and redeploy the proceeds into more domestic businesses that can benefit from easier financial conditions overseas.

U.K. supermarket chain Tesco, in the secular growth bucket, is a good example of a company focused on its home markets of the U.K. and Ireland. Shares sold off in March following widespread price cuts by a U.K. competitor, providing an attractive entry point into a company we believe is best positioned in an industry facing accelerating food inflation. While U.K. discounters have increased competition, Tesco can expand margins through investments in loyalty programs, scale-driven efficiencies and optionality from its wholesale distribution business.

We shifted our financials exposure, swapping out of U.K.-based Lloyds Banking Group in favour of NatWest, which has gone through a decade-long restructuring that included a government bailout following the Global Financial Crisis but is finally returning to normalcy. NatWest has a quality loan book and, with lending subdued the last several years, it has less bad debt on its balance sheet. It is the most interest rate sensitive of the large U.K. banks, with net interest income, expected to increase over the next three years, poised as a major driver of future earnings.

The addition of Vertiv, in the industrials sector, broadens our participation in the AI theme. The U.S. company has key offerings to power, cool, deploy, secure and maintain electronics that process, store and transmit data. Vertiv generates the majority of its revenue from the data centre end market, which we believe should benefit from continued spending growth supported in part by the rise in power requirements of next-generation AI graphic processing units (GPUs). Vertiv replaces data centre operator Equinix, which we exited as it has not participated in the generative AI tailwind demand for data centres because most activity to date has been model training by hyperscalers that own their own data centres, rather than the enterprise environments Equinix supports.

The repurchase of digital services conglomerate Tencent is part of our cautious return to China as Beijing becomes more active in supporting economic growth. The company’s valuation is attractive again, with its core gaming business doing well on new game launches. Due to the reach of its content/data ecosystem on WeChat and other platforms, we believe Tencent is well-placed to use AI solutions to accelerate growth through better user experience and increased advertising.

We exited Novo Nordisk as continued weakness due to the presence of GLP-1 compounders and a lack of uptick in prescriptions has weighed on the Danish diabetes and obesity drug maker. We will continue to monitor the company for strong signals as to whether it can regain its share of this large market.

We exited French advertising firm Publicis Groupe as our investment thesis has been dampened by increased economic uncertainty and a very challenged advertising industry. The company also faces possible regulatory changes against pharma advertising, and a new existential threat from AI, which can replace thousands of employees at global ad agencies.

Outlook

In addition to a resilient U.S. equity market that is showing some signs of broadening past mega caps, the regions where we invest continue to make progress on growth and equity-friendly policies. While still early days in the development of more stimulative economic and regulatory policies, earnings growth among stocks in the pan European Stoxx 600 has begun to improve with forecasts for double-digit EPS growth over the next year. The U.S., meanwhile, is expected to see earnings growth reaccelerate in 2026.

We believe China is also becoming more investable, with its push to develop a self-sufficient health care system leading to a burgeoning homegrown biotechnology industry. As we detail in a new blog, the world’s second-largest economy has the necessary institutional commitment to R&D and life sciences infrastructure to become a profitable global competitor to Western biopharmaceutical companies. We are actively looking at the key players in this rapidly developing market.

Portfolio Highlights

During the second quarter, the ClearBridge Global Growth Strategy outperformed its MSCI ACWI benchmark. On an absolute basis, the Strategy produced positive contributions across seven of the nine sectors in which it was invested (out of 11 total), with the IT and communication services sectors the top contributors and health care the primary detractor.

On a relative basis, overall stock selection and sector allocation contributed to performance. In particular, stock selection in the communication services, consumer discretionary, consumer staples and IT sectors, an overweight to communication services and a lack of exposure to the energy sector drove results. Conversely, stock selection in the financials sector and an overweight to consumer staples detracted from performance.

On a regional basis, stock selection in North America (primarily the U.S.), Europe Ex-U.K. and emerging markets contributed to performance while stock selection in Asia Ex Japan proved detrimental.

On an individual stock basis, the largest contributors to relative returns in the quarter were Roblox in communication services, Siemens Energy in industrials, SK Hynix and Broadcom in IT and Dollarama in consumer discretionary. The greatest detractors from relative returns included positions in T-Mobile US in communication services, BYD in consumer discretionary, Marsh & McLennan in financials, Lenovo Group in IT and Union Pacific in industrials.

In addition to the transactions mentioned above, we initiated a position in Life 360 in IT. Additional sales included L’Oreal and Danone in consumer staples, Old Dominion Freight Line and ABB in industrials, Chubb, London Stock Exchange and S&P Global in financials and Zealand Pharma in health care.

Related Perspectives

Resilience, Reforms, and the Road Ahead for India

India’s long‑term growth opportunity is underpinned by favorable demographics, rising domestic consumption and corporate reforms.

Read full article