Periods of substantial uncertainty offer an opportunity for individuals and professionals alike to gain an investment edge by lengthening their time horizon.

Perspectives

Stay up-to-date with the current investment and macroeconomic issues at ClearBridge Investments. We provide analyses of the themes and trends which lie at the heart of your investment challenges.

China Emerging as Global Biotechnology Player

Evolving from its fast follower approach, an expanding number of Chinese biotech companies are licensing new compounds to multinational pharmaceutical firms.

More...

Infrastructure Steady as Equities Swing

Despite recent strong performance for listed infrastructure versus equities, infrastructure valuations are still attractive on a risk adjusted basis, and could have room to run.

More...

AOR Insights: What a Difference a Week Makes

Trade truces with China and the U.K. are just what the economy and equity markets needed to neutralise the effects of elevated policy uncertainty.

Q&A: Shifting U.S. Sustainability Priorities Resonate Globally

As the new U.S. administration enters the global stage, Portfolio Managers Jean Yu and Benedict Buckley discuss whether and how sustainability priorities are changing, both in the U.S. and globally.

More...

AOR Update: Recession or Vibecession?

The risk-reward tradeoff facing the economy and financial markets skews unfavourably, although a positive trade shift or pivot to deregulation or tax cuts could reverse this.

ClearBridge Investments 2025 Stewardship Report

Our eighth annual stewardship report efforts offers an in-depth view of the latest in ESG integration and sustainability investing at ClearBridge, including how we are engaging with portfolio companies and voting proxies on pressing environmental, social and governance issues.

More...

The Long View: Diversification for Uncharted Waters

While the U.S. has outperformed long term, international equities tend to pick up the slack when domestic markets falter.

More...

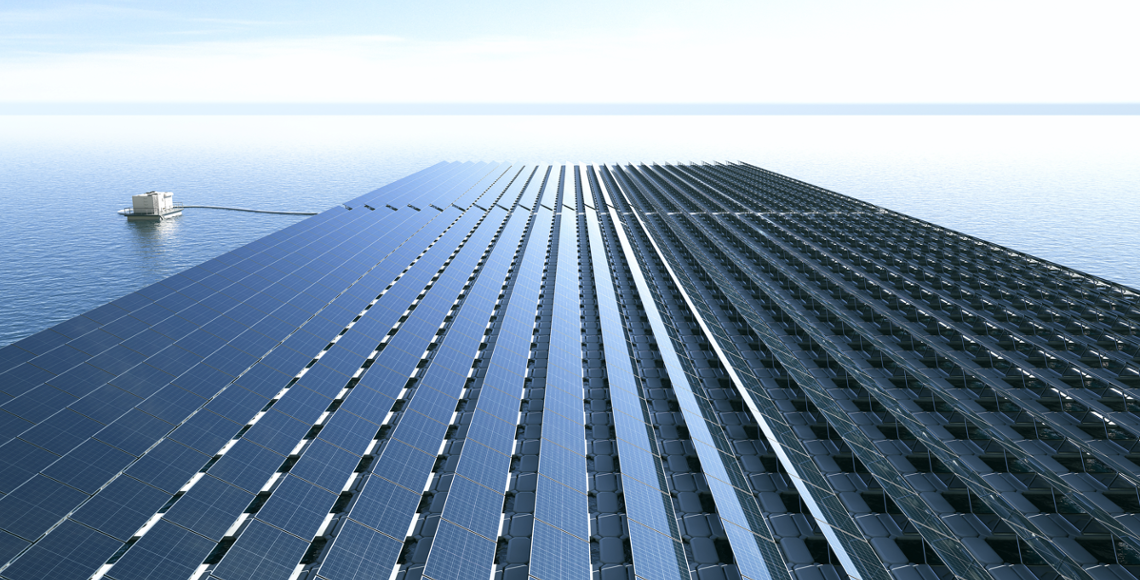

Infrastructure Poised to Mostly Weather Tariff Storm

A new regime of tariffs will likely create the need for more infrastructure to support reshoring, while utilities' lack of exposure to international trade may bolster their defensiveness.

More...

The Rising Case for Non-U.S. Equities

Massive fiscal reforms in Europe and resolution of the Russia-Ukraine war could help close the leadership gap between the U.S. and the rest of the world.

More...

International Does Heavy Lifting For a Change

Q1 2025 Global Growth Strategy Commentary: Global equities outside the U.S. outperformed as increasing policy uncertainty under the new Trump administration spurred investors to look overseas.

More...

AOR Update: As Good as It Gets?

Surging policy uncertainty has dented sentiment, raised inflation risk and stalled the market rally. Should uncertainty ebb in coming months, risk assets should rebound.