2026 Australian Equity Outlook

Valuation Dispersion, Earnings Recovery, AI Impacts and Portfolio Opportunities

The Australian market experienced a robust 2025. Senior Client Portfolio Manager, Ross Kent, sits down with Portfolio Manager and Head of Australian Equities, Reece Birtles to explore the dynamic landscape that Australian Equities experienced over 2025, the improving earnings and dividend growth, the impact of artificial intelligence (AI) on Australian companies, and the ongoing value and income opportunities being targeted by the ClearBridge Australian Active Equity and Equity Income portfolios in 2026.

Key Takeaways

- The Australian market experienced a robust 2025, with the S&P/ASX 200 rising over 10%. High-beta names performed, while expensive growth names lagged, influenced by falling rates and subdued inflation.

- Value-style investing showed remarkable results, but valuation dispersion remains wide in Australia, creating an attractive environment for active stock selection among higher-quality, lower-risk companies.

- Specialist income portfolios continue to offer compelling yield, with expected franked income and growth expectations well above the broader Australian market.

- Earnings momentum in Australia is improving, led by resources and supported by stronger commodity prices and improving domestic consumer and business confidence versus the U.S.

- AI may present business-model risk for some Australian growth companies, but asset-intensive, market-leading businesses are well positioned to adapt and invest.

- Save 12 March in your diaries to join our bi-annual Reporting Season Wrap webinar for further insights into how companies are adapting to AI's transformative potential. Click here to register

Looking back at 2025, what factor exposures were waxing and waning for Australian equities over the course of the year?

Reece Birtles: It was a very strong market return year for Australian equities, with the S P/ASX 200 Accumulation Index up more than 10%. In that environment, we saw high-beta names do quite well, but expensive growth names didn’t. This was really driven by the falling rate environment, and the more subdued inflation. Even though the economy was a bit sluggish, the AI capex theme really helped many Australian names. We also can't not talk about Australian resources, given how much the gold price was up in 2025, but not just gold, it's also copper, rare earths, lithium and even iron ore names have been strong.

This time last year you were talking about the strength of the ‘Value Opportunity’. How do you see it looking this time this time round?

Reece Birtles: It's been a great year for the value-style, with strong relative performance for our value-focused portfolios.

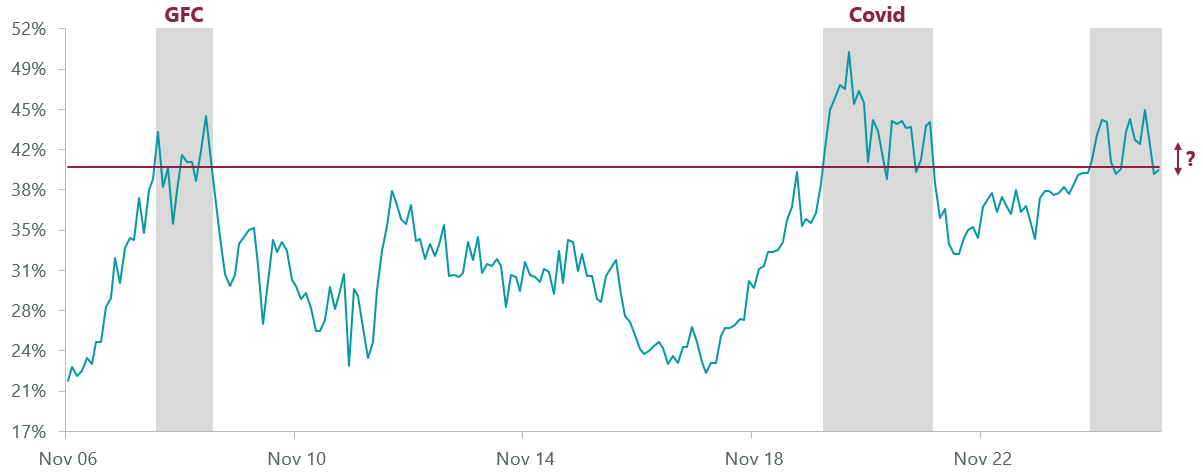

What we talked about 12 months ago was our proprietary valuation spread (Exhibit 1), i.e., what's the gap between the cheap stocks (that we target) and the expensive stocks (that we avoid) in the market? When it hits a level above 40%, which we have previously seen in Covid, in the GFC and in the Tech Bubble, we find that it's a great time to invest on a fundamental value basis.

Exhibit 1: Proprietary Valuation Spread

Source: ClearBridge, FactSet; as of 31 December 2025. Based on Proprietary Valuation of ClearBridge Australian Value Equity representative account vs. Proprietary Valuation of S&P/ASX 200 (log). Past performance is not a guide to future returns.

We've had good performance in 2025, but in our view, we are still early in the process of value reasserting itself. The disconnect between share prices and fundamental valuation remains wide, but the market is starting to show classic signs that the momentum phase, and crowded, index-dominated growth names are losing their shine, just as we explored in our recent piece, The Emperor’s New Clothes.

Importantly, value-style stocks continue to be a low-beta, a lower-risk expression, providing fundamental earnings resilience in the current environment. Just as we saw during the Tech Bubble, in periods of exuberance rather than crisis, value provides downside protection precisely when euphoria unwinds. That means that the risk return trade-off for an active portfolio is quite good. Despite this, many investors remain heavily skewed toward growth exposures, leaving their portfolios vulnerable if the full rotation toward value accelerates.

For a more sector or factor neutral portfolio, like ClearBridge Australian Active Insights, can it also capitalise on that type of opportunity?

Reece Birtles: Alpha and Risk really come from two things - it's from your stock picking ideas, and also from style risk. What our Active Insights portfolio really does is to drill in on those stock ideas, without taking the associated style risks. Given the extreme valuation spread available in quality companies, we are finding that it’s been a rich stock picking environment for our style of investing.

Some of the names that have done well in our portfolios across the board include ANZ Banking Group, Lynas Rare Earths, BHP Group, Ventia Services Group, and Downer EDI.

Turning to our income portfolios, in the past you have spoken about the dearth of earnings per share (EPS) growth out of the Australian market generally, and the index expected yield is low. Does that also signal a tough time for income portfolios?

Reece Birtles: Surprisingly not. The expected next 12-month franked yield on our suite of income portfolios (Equity Income, Ethical Income, Sustainable Income) is still near 6%, while the S&P/ASX 200 index yield is much lower at around 4%. This spread is close to a record multiple of the index. This is a very welcome premium for investors whose index portfolio yields have retreated well below long-term averages in the face of expanding multiples unsupported by strong earnings growth.

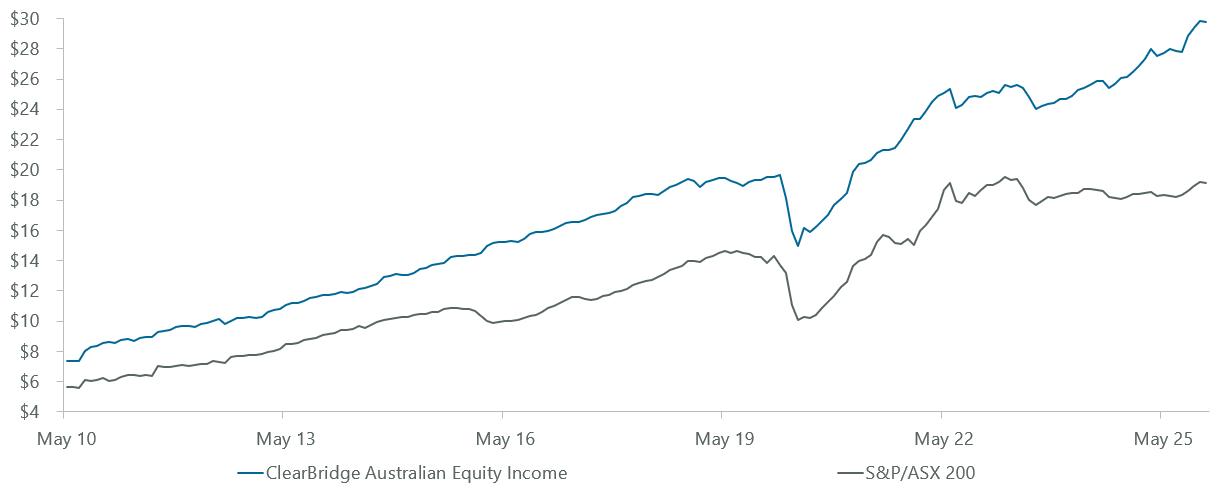

The yields of our income portfolios are driven in part by that valuation spread environment from quality companies we talked about earlier. The good companies we invest in are more attractively valued, but ironically, those good companies are also growing faster than the broader market in terms of earnings and dividend growth (Exhibit 2). On the other hand, the more expensive technology sector names and passive darlings are not providing sufficient (if any) earnings or dividend growth.

Exhibit 2: Expected Income from A$100 (with Dividends Reinvested)

Source: ClearBridge, FactSet; as of 31 December 2025. Data calculated for a ClearBridge Australian Equity Income representative account in A$, gross of management fee. Expected next 12 Months (NTM) income is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will vary depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days. Assumes zero percent tax rate and full franking benefits realised in tax return. Past performance is not a guide to future returns.

Our income portfolios are thus benefiting from stronger dividend growth than the market and they are also cheaper than the market. That's why we have such a big spread between the expected franked income yield of the portfolio and the index. You can read more about our income philosophy in our latest piece, Preparing Your Income Portfolio for Shifting Conditions.

Coming into the reporting season what are you on the lookout for in terms of signals for EPS growth?

Reece Birtles: There has been a dramatic turn in EPS growth for Australian stocks compared to markets offshore.

Since the August 2025 reporting season, we have seen significant upgrades to expected EPS growth. We are probably more in that double-digit area now, but it has really been concentrated in the resource space. From an index point of view, it's really driven by the market cap of the iron ore names, however, copper exposures, gold, lithium and rare earths are also contributing.

Now, that's narrow from a sector perspective at this point in time, but what we expect to see is stronger commodity prices improve Australia's terms of trade and drive nominal GDP growth. That's a great predictor for the revenue, earnings and dividend growth of Australian companies more broadly. We do think we'll get to a spreading out of sectors contributing to EPS growth.

Another thing that's happening right now is that Australian consumer confidence and business condition surveys are showing much stronger reads than their equivalents in the US. On a relative basis, we believe that while Australia had been a laggard market in terms of EPS growth globally, it now looks a lot stronger in 2026.

Finally, the world seems awash with capital chasing the prospective returns from AI. In the Australian market, where do you see the balance of risks and opportunities for the market?

Reece Birtles: Australia is clearly not the ‘heart of AI’ when you think of it in terms of Nvidia, OpenAI and the companies driving big change. However, for Australian companies, we believe that it's more important to think about the risks that AI can bring to companies, such as how AI could change business models, or change the ability to charge, and thus what it might mean for future earnings and vulnerability.

The interesting thing that we have found is that companies that are more physical in their presence, such as those in the real asset space or those with heavy assets or intensive process requirements, are actually relative beneficiaries from AI. Large companies in Australia are often oligopolistic, with strong market position and the scale to invest, and we find that the companies that we invest in for our various portfolios really look quite low risk from the threat to AI changing their business models.

Conclusion

While value-style investing rewarded investors’ faith in 2025, and spreads have started to tighten from their peaks, the valuation dispersion remains wide in Australia, proving an ongoing attractive environment for active stock selection among higher-quality, lower-risk companies into 2026.

Earnings momentum in Australia is improving generally, led by resources and supported by stronger commodity prices and improving domestic consumer and business confidence versus the US. Disruptions from AI may present business-model risk for some Australian growth companies, but asset-intensive, market-leading businesses are well positioned to adapt and invest.

Back in September, in our Reporting Season Wrap, we outlined two paths for investors looking to capture the opportunity ahead:

- Our Australian Value Equity Strategy, which today offers some of the highest upside potential we have seen in two decades; or

- Our Australian Active Insights portfolio, which applies a more nuanced, risk-factor–controlled framework to access the same valuation opportunity with a more balanced risk profile.

Both approaches, or a combination of the two (as we do for our Australian Dynamic Value Strategy clients), remain compelling, and both allow allocators to position for what we believe could be a multi-year regime shift as fundamentals reassert themselves.

Finally, for income-oriented investors, higher quality Australian Equity Income portfolios also continue to offer a compelling yield, with expected franked income and growth expectations well above the broader Australian market due to the valuation spread environment and strong earnings growth from quality companies.

Ultimately, we believe that the type of Australian equities we invest in on a fundamental value basis are offering an attractive upside for returns and defensive qualities amid shifting economic conditions and rapid technological advancements.

Related Perspectives

Metals, Commodities and Engineering of the Future

The transition to a lower carbon global economy is not about technology shifts. Australian Equities offer exposure to the multi-decade build-out of physical materials, infrastructure and engineering capabilities, and sustained demand for their metals, materials and engineering capabilities.

Read full articleDisclaimer

Franklin Templeton Australia Limited (ABN 76 004 835 849) is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001. The ClearBridge Australian Equities Investment Team, a division of Franklin Templeton Australia Limited, is operationally integrated under the “ClearBridge Investments” global brand, alongside ClearBridge Investments, LLC (“CBI”), and other ClearBridge entities indirectly wholly owned by Franklin Resources, Inc. Distribution of this material is issued and approved in Australia by Franklin Templeton Australia Limited.

This video is issued for information purposes only and does not constitute investment or financial product advice. It expresses no views as to the suitability of the services or other matters described in this video as to the individual circumstances, objectives, financial situation, or needs of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision.

Neither ClearBridge Investments, Franklin Templeton Australia, nor any other company within the Franklin Templeton group guarantees the performance of any strategy, nor do they provide any guarantee in respect of the repayment of your capital.

The video does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this video and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this video has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by the investment team, within the strategy referred to in this video. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable. It is not known whether the stocks mentioned will feature in any future portfolios managed by the investment team. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this video.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

© 2026 Franklin Templeton Australia Limited. All rights reserved