Rate Pivot Poised to Help Towers and Renewables

Global Infrastructure Value Strategy Commentary Q2 2024

Key Takeaways

- Infrastructure rose in the second quarter but trailed global equities modestly as strength in defensive sectors faded late in the quarter.

- Growing power demand from data centres supporting AI was a positive for both utilities and energy infrastructure.

- With increased confidence that we are at the end of the rate hiking cycle and now looking toward the start of the rate-cutting cycle, we believe this could be the start of the turn for many of our long-duration assets such as towers and renewables.

Market Overview

Infrastructure and global equities rose in the second quarter, with infrastructure trailing global equities modestly as strength in defensive sectors faded late in the quarter, despite a moderation in bond yields. Overall, as investors began to appreciate the growing power demand from data centres supporting AI, this was positive for electric utilities. Energy infrastructure also benefited from an improving natural gas price outlook and growing acknowledgment that midstream infrastructure plays a key role to back up renewable power as AI demand grows.

Airports were weaker, by contrast, amid lower summer traffic expectations for some European airports, while a mix of coal haulage, fuel headwinds and a loose truck market placing pressure on tariff increases for the rails weighed on that sector.

By region the U.S. and Canada delivered the strongest performance, with returns cantered around the abovementioned drivers for electric utilities and energy infrastructure, while concerns over possible government intervention in Brazil weighed on performance in Latin America. Japan’s rail traffic recovery plateaued and looked to settle on a new normal, meanwhile, dragging down Asia Pacific Developed. We used the opportunity to crystallise some gains and exited our positions in Japanese rail operators Central Japan Railway and East Japan Railway.

In addition to airports weighing on Western Europe, U.K. water lagged largely due to political turmoil in the U.K., with a snap election and a water regulator ruling set for early July. Listed water companies there have also been unduly discounted due to trouble at an unlisted peer. Near-term political volatility could represent a buying opportunity for listed U.K. water utilities, however. Their spending on improving environmental impacts adds to the bottom line, and their investments can earn attractive allowed returns, which translates to better earnings and dividends. The listed water infrastructure companies we like are leaders in environmental responsibility with strong track records and targets for environmental performance that we believe the regulator and investors will reward over time.

Outlook

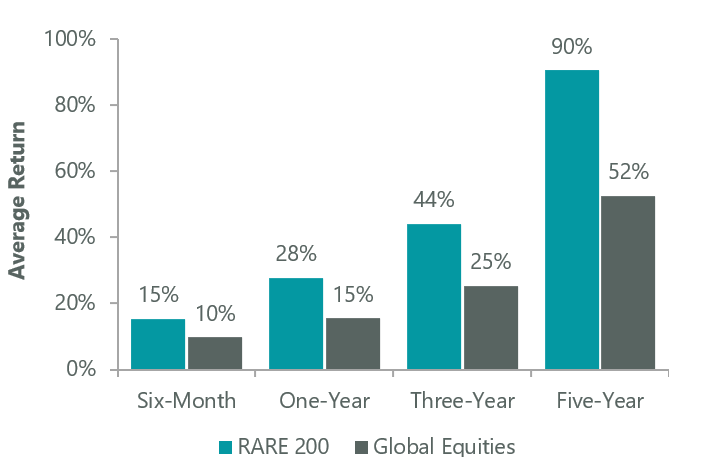

Whilst the past 12–18 months have been challenging for infrastructure due to the sharp rise in bond yields and bond volatility, in addition to the narrow market breadth, we think the macro headwinds are starting to become tailwinds. Historically, we have seen infrastructure outperform global equities over several time periods as interest rates have peaked (Exhibit 1), something to keep in mind as inflation indicators slow and allow major central banks to move toward easing. We also believe bond yields need not roll over for investors to benefit from infrastructure returns, but that merely reduced volatility of bond yields could be supportive of valuations, something we have seen in the past.

Exhibit 1: Infrastructure Performance Following Last Fed Rate Hikes

As of 31 March 2024. Source: ClearBridge, FactSet, Bloomberg. The RARE 200 is the combination of the investment universes (updated on a quarterly basis) for ClearBridge Investments’ infrastructure strategies. Constituents as of 31 March 2024, measuring total return in local currency. Global equities: MSCI AC World Index, gross returns in local currency. Performance reflective of the six-month, one-year, three-year and five-year period following the last Fed rate hike prior to cutting cycles in 1989, 1995, 2001, 2007 and 2019.

We remain generally balanced between more defensive regulated utilities and more GDP-sensitive infrastructure names. With increased confidence by market participants that we are at the end of the rate hiking cycle and now looking toward the start of the rate-cutting cycle, we believe this could be the start of the turn for many of our long-duration assets such as towers and renewables. Notwithstanding near-term supply-side constraints around labour and aircraft deliveries, we are positive on airports, where valuations are attractive. Utilities should continue to benefit from themes of electrification, renewables growth and more recently higher electricity demand from data centres, and we remain constructive on the sector, given reduced valuations.

Related Perspectives

Structural Tailwinds Make Utilities High Income and High Growth

Q2 2024 Infrastructure Income Strategy Commentary: Growing power demand from AI data centres is a positive for both utilities and energy infrastructure.

Read full article