Global Improvers Gain as Investors Look Overseas

Global Value Improvers Strategy Commentary Q1 2025

Key Takeaways

-

International value stocks rose during the first quarter despite the outbreak of trade wars, as a rotation out of U.S. technology and the prospect of greater fiscal stimulus in international markets helped bolster returns.

-

The Strategy posted positive absolute returns but slightly trailed its benchmark as detractors in consumer staples overcame positive contributions from our energy holdings.

-

Despite market noise, there remain many durable themes, such as the energy transition and artificial intelligence deployment, that we will look to add to opportunistically.

Market Overview

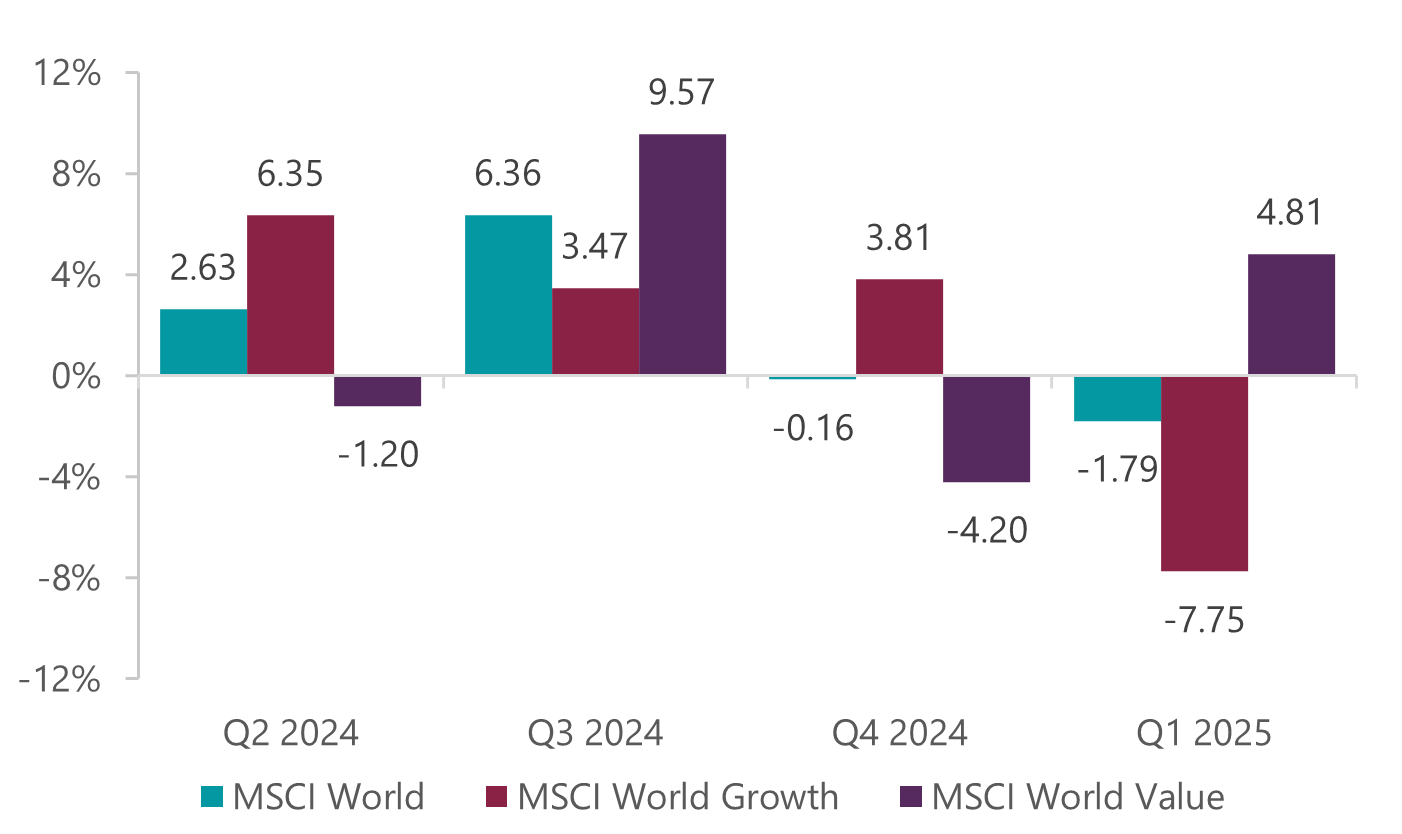

Global value stocks rose during the first quarter despite the outbreak of trade wars, as a rotation out of U.S. technology and the prospect of greater fiscal stimulus in international markets helped bolster returns. The core MSCI World Index declined 1.79% while the S&P 500 Index and the more tech-heavy NASDAQ Composite declined 4.27% and 10.42%, respectively. Meanwhile, the financials sector continued to rally to new highs, along with traditional defensives, which were less impacted by tariff threats, helping the MSCI World Value Index (4.81%) handily outperform the MSCI World Growth Index (-7.75%) by over 1,200 basis points (Exhibit 1).

Exhibit 1: MSCI World Growth vs. Value Performance

As of 31 March 2025. Source: FactSet.

Tariffs were front and centre in the news following the inauguration of President Trump, as the administration rapidly pushed through a series of domestic and economic policies including the imposition of tariffs on steel and aluminium, imported autos, all goods from China and many from Canada and Mexico. This sparked trade wars as targeted countries reciprocated, weighing on the prospects for U.S. economic growth and raising inflation expectations. Additionally, the unveiling of Chinese AI model DeepSeek in late January, with reportedly lower development costs and less need for computing power of comparable AI tools, resulted in a selloff of the U.S. information technology (IT) sector and a rotation away from the AI beneficiaries that generated strong returns in 2024.

In Europe, the new centre-right coalition government in Germany quickly acted to formulate a new economic revitalisation plan that includes significant infrastructure spending, debt brake reform and further defence spending. The prospect of further stimulus also helped removed some of investors’ bearishness on Chinese markets, as the retaliatory tit-for-tat tariff escalations between the U.S. and China have given rise to hopes that the Chinese government would ready and deploy additional support for the world’s second-largest economy.

Quarterly Performance

The ClearBridge Global Value Improvers Strategy posted positive absolute returns but slightly trailed its benchmark in the first quarter, which was a period where high-dividend-yielding sectors such as energy, utilities and financials generally led the market. Detractors largely came from our underweight and stock selection within consumer staples, while our holdings within the energy sector generated positive contributions.

Prestige fragrance company Coty weighed on overall stock selection within the consumer staples sector. Coty continued its decline alongside other health and beauty companies following weaker than anticipated quarterly earnings and reduced full-year guidance citing incremental retailer destocking, a slowdown in the company’s U.S. mass beauty line and incrementally worse performance in China. An uncertain economic outlook and tariffs, and signs of wavering consumer sentiment and spending, added to investor concerns about the company’s outlook.

Stock selection in the energy sector was the greatest contributor to relative performance during the period, with one of our top contributors being EQT. America’s largest and cleanest natural gas producer saw an upward trajectory alongside energy prices on the expectation of relatively tight supply-demand conditions amid potential stricter U.S. sanctions on oil from Russia, Iran and Venezuela as well as scaling U.S. LNG exports. EQT continues to capitalise on strong operational performance, make additional progress on its goal of deleveraging and developing synergies from its acquisition of Equitrans Midstream in 2024, and remains on track to be net zero on Scope 1 and 2 GHG emissions by the end of the year.

Performance in industrials, many of which were our best-performing holdings in 2024, was mixed as many of them faced greater uncertainty — both from less supportive infrastructure spending policies under the new Trump administration and from concerns over a slowdown in AI capex and the outbreak of trade wars. French high-voltage cable supplier Nexans saw a pullback in earnings expectations and added concerns that a potential halt to new offshore wind projects by the Trump administration could lead to a decline in demand. Meanwhile, industrial conglomerate Hitachi saw its share price decline due to a management changeover from a highly regarded CEO and uncertainty around its next midterm plan. However, these were more than offset by a strong contribution from German automation and digitalisation company Siemens, which delivered strong first-quarter results. In addition to its unique position to capitalise on greater fiscal spending by the new German government, the company continues to show momentum in its digital business and the completion of its Altair acquisition, helping propel Siemens’ strong fundamentals back into the spotlight.

Portfolio Positioning

Our largest new position during the period was Nestle, a Switzerland-based global packaged foods company. We capitalised on an attractive entry point for a company with broad geographical exposure to markets with resilient consumer spending, like Europe and emerging markets, and strong brands within such brands as pet food and coffee. As a result, we believe the company has multiple opportunities to unlock value for shareholders and re-rate higher. On the ESG side, Nestle is also making progress promoting balanced and sustainable diets. In 2023 it became the first company to report the nutritional value of its entire global portfolio using the government endorsed Health Star Rating (HSR) nutrient profiling model and is targeting to grow the “healthy” portion of its product portfolio by 50% by 2030. Additionally, reformulation of products to reduce sugar is a key focus for the company, and it aims to use technology to reduce sugar content by up to 30%.

Within health care, we swapped our existing position in U.S.-based UnitedHealth Group, a leading diversified health care company that offers health benefits and services, for a new position in Novo Nordisk, a Danish pharmaceutical company and a leader in the blockbuster diabetes and obesity market. We exited UnitedHealth after the Department of Justice launched an investigation into its Medicare Advantage billing practices. While these concerns are not necessarily new, recent heightened attention around insurance coverage denial and reimbursement policies led us to be more concerned about the social impact of its business practices and risk of further regulation.

On Novo, we took advantage of the market’s concern over underwhelming trial data from its newest generation obesity treatment, as well as lack of an oral drug alternative, which competitors are developing. However, since injectables are likely to maintain meaningful share of the market, Novo’s manufacturing scale is still a significant advantage. Longer term, the obesity market remains one of the largest and growing market opportunities in the industry. Additionally, we believe the social impact of the GLP-1 class of drugs is profound, as they can deliver weight loss results previously unachievable without surgery. The health benefits of such weight loss span multiple chronic conditions such as diabetes, heart disease, high blood pressure, sleep apnea and chronic kidney disease. The wide adoption of such drugs will continue to have significant impact on population-wide health and wellness.

Outlook

Despite heightened volatility caused by the ever-evolving trade dynamic, we are encouraged by the broadening of sector flows and the potential for regime change in favour of value and non-U.S. stocks. We expect this uncertainty to persist for the foreseeable future and look to take advantage of attractive valuation opportunities offered up by market dislocations.

We believe the current environment supports our flexible but process-driven philosophy. On the one hand, we are focused on absolute value opportunities, particularly businesses with fortress-like balance sheets that trade at low multiples of free cash flow. These types of businesses should not only be resilient in times of economic stress but also emerge from market turmoil in better competitive positions to deploy their balance and drive future growth. On the other hand, we believe that indiscriminate market selloffs can also offer chances to buy secular growth companies at valuations that imply little future growth. Despite market noise, there remain many durable growth themes, such as the energy transition and artificial intelligence deployment, that we will look to add to opportunistically.

Portfolio Highlights

The ClearBridge Global Value Improvers Strategy underperformed its MSCI World Value Index benchmark during the first quarter. On an absolute basis, the Strategy had gains in seven of the 10 sectors in which it was invested (out of 11 total). The financials sector was the greatest contributor while the IT sector was the largest detractor.

On a relative basis, overall stock selection detracted from performance. Specifically, stock selection in the consumer staples, IT, utilities and materials sectors, as well as an overweight to the industrials sector, weighed on performance. Conversely, stock selection in the energy and financials sectors and underweights to the IT and consumer discretionary sectors proved beneficial.

On a regional basis, stock selection in the U.K., Europe Ex U.K., North America and Japan weighed on performance. Conversely, overweight allocations to the U.K., Europe Ex U.K. and emerging markets and an underweight to North America proved beneficial.

On an individual stock basis, Banco Bilbao Vizcaya Argentaria, CVS Health, Piraeus Financial, TotalEnergies and Siemens were the leading contributors to absolute returns during the quarter. The largest detractors were PayPal, ICON, Vertiv, Nexans and Hitachi.

During the quarter, in addition to the transactions mentioned above, the Strategy initiated new positions in Walt Disney in the communication services sector and Microchip Technology in the IT sector.

ESG Highlights: SDGs Key for Productivity and Growth

While some of the United Nations Sustainable Development Goals, or SDGs, consider elemental topics such as water, hunger, poverty, good health and education, and are therefore easier to understand and discuss, SDGs such as Decent Work and Economic Growth (SDG 8) and Industry, Innovation and Infrastructure (SDG 9) may be lesser known or understood. These emphasise the importance of sustainable development and are a focus for ClearBridge as they are among the SDGs most reliant on the private sector for progress.

Investing in Decent Work and Economic Growth

SDG 8 aims for decent work and economic growth, and includes promoting inclusive and sustainable economic growth, with employment and decent work for all. Among its targets (8.2) is achieving higher levels of economic productivity through diversification, technological upgrading and innovation, including a focus on high-value-added and labour-intensive sectors. Enterprise software aids in this goal, as the products and services of companies like ClearBridge holdings ServiceNow, Microsoft and Salesforce are key for enhancing economic productivity. IT services companies such as Accenture help companies implement technology upgrades.

Other examples of technology upgrading across industries include Amazon’s robotics-enabled warehouses, which are delivering speed increases that do not come at the expense of employee health, as we discussed in a recent engagement with the company. Amazon’s fulfilment centre (FC) recordable injury rate (injuries considered exceeding first aid) is down 34% from 2019 to 2024 and 6% year over year and now stands at 4.4%. Lost-time injuries are down 65% over five years and 13% year over year, showing that safety investments are paying off. With 750,000 robots across fulfillment centres, FCs equipped with next-gen robotics have approximately 20% lower injury rates and lost-time injury rates than FCs without.

Amazon compares favourably to peers on its lost time incident rate (LTIR) and its recordable incident rate (RIR), with a LTIR better than the general warehousing and storage industry and courier and express delivery services industry averages and a RIR better than courier and express and that is quickly catching up to the general warehousing and storage average. Amazon has also implemented more shift types to offer flexibility, including an “anytime shift” where employees can block out a certain day of the week.

Other examples of technology upgrading include Deere’s precision agriculture offerings and connected combines, which are upgrading the technological capabilities of the agricultural sector, and Ecolab’s digital service offerings for remote monitoring and analytics to improve operational efficiency of its customers.

Enabling Resilient Infrastructure and Advancing Research

SDG 9 supports industry, innovation and infrastructure through building resilient infrastructure, promoting sustainable industrialisation and fostering innovation. Among its targets (9.1) is developing quality, reliable, sustainable and resilient infrastructure to support economic development and human well-being, with a focus on affordable and equitable access for all. Helping this target are ClearBridge holdings Vulcan Materials, which makes aggregates (such as gravel) for roads and other infrastructure, and United Rentals, which provides construction equipment such as scissor lifts, forklifts, loaders, excavators, hoists and cranes in a resource-efficient rental model that increases equipment utilisation and reduces wasted capacity.

Resilient infrastructure may be supported by green building practices of real estate investment trusts like AvalonBay Communities, which owns and develops apartment properties. In a recent engagement with the company, we discussed AvalonBay’s submission to the Science-Based Targets initiative of a new emissions reduction target aligned to 1.5°C climate science, rather than its current 2°C target. This change, along with goals of 60% declines in Scope 1, 2 and 3 emissions off a 2017 baseline by 2030, help ensure AvalonBay is bringing high sustainability standards to the ~300 communities and 91,000 homes it owns and develops. Other highlights of AvalonBay’s sustainable development include the use of embodied carbon emissions tracking (embodied emissions are those associated with the production stages of a product’s life), biodiversity and climate risk assessments, construction waste recycling and drought-tolerant and native plantings in its new development communities.

Electrification is also a key component of this target of SDG 9, and is supported by Eaton, whose electrical equipment enables the electrification of the power grid and, importantly, electrical vehicle charging infrastructure.

SDG 9 also includes a target (9.5) to enhance scientific research and upgrade the technological capabilities of industrial sectors in all countries and to increase the number of research and development workers per 1 million people. Semiconductors are a foundational technology for sustainable development. Almost every technology development in every sector is reliant on the development of better and better semiconductors, and many businesses ClearBridge owns and engages with are essential parts of that ecosystem:

- Synopsys (which makes semiconductor design software)

- ASML and Lam Research (which make tools that produce semiconductor chips)

- Nvidia and Broadcom (which design semiconductor chips)

These are also some of the most R&D-intensive businesses outside of health care. For example, every year Synopsys re-invests more than 30% of its revenue back into R&D to improve its next generation of chip design software. Also on this note, companies like Alphabet are innovating with research across multiple fields, including long-term research into areas like quantum computing.

The list could go on, but it is worth mentioning SDG 9’s target (9.c) to increase access to information and communications technology and strive to provide universal and affordable access to the Internet in least developed countries. Serving this goal too, then, is Amazon’s Project Kuiper, an initiative to use a network of low Earth orbit satellites to give affordable broadband access to underserved areas of the world without reliable connectivity.

Related Perspectives

Global Infrastructure Income Strategy May Commentary

Tariffs are unlikely to have a meaningful impact on utility earnings given they service domestic catchments with electricity, gas and water, and are not directly exposed to international trade.

Read full article