Surging policy uncertainty has dented sentiment, raised inflation risk and stalled the market rally. Should uncertainty ebb in coming months, risk assets should rebound.

Perspectives

Stay up-to-date with the current investment and macroeconomic issues at ClearBridge Investments. We provide analyses of the themes and trends which lie at the heart of your investment challenges.

Global Improvers Gain as Investors Look Overseas

Q1 2025 Global Value Improvers Strategy Commentary: Global value stocks rose as a rotation out of U.S. tech and the prospect of greater fiscal stimulus in Europe helped bolster returns.

More...

Emerging Markets Strategy March Commentary

During the quarter, we exited our positions in Chinese electric utility China Power International and Chinese toll road operator Shenzhen Expressway.

More...

Global Value Improvers Strategy February Commentary

Politics and trade concerns remained centre stage in February, as discussions and negotiations around tariffs by the new U.S. administration and retaliatory tariffs by trade partners weighed on global markets, driving value to outperform growth stocks.

More...

Global Growth Strategy February Commentary

Global equities finished February mixed as the Trump administration fanned the flames of a new trade war by pushing through tariffs on Chinese goods and threatening similar levies on its North America trading partners.

More...

Renewables Under Trump: Likely Better than Expected

Changes to the Inflation Reduction Act should be less than the market anticipates and ultimately have a muted impact on the strong short- and long-term renewables outlook.

More...

Valuation of Infrastructure Assets Q4 2024

In our latest Valuation update, Portfolio Manager, Daniel Chu, discusses trends affecting infrastructure sector performance and reviews current valuations.

More...

AOR Update: The Average Stock Selection

We expect investors will embrace cheaper areas of the market like value, small and mid caps as earnings delivery broadens.

The Long View: Mean Reversion or Gambler's Fallacy?

Two years of strong gains don’t make U.S. equities due for a pullback, as the market has typically continued to climb.

More...

Year of the Election: Why New Global Leadership Matters

While Donald Trump’s presidential victory has dominated global headlines, a number of key election results outside the U.S. could have significant impacts on international markets going forward.

More...

U.S. Equity Outlook: Guarded Optimism Amid Bullishness

CIO, Scott Glasser explains why he expects U.S. returns to be more subdued but positive in the year ahead given ample liquidity, healthy corporate profits and animal spirits buoyed by expectations of a pro-growth, deregulatory agenda.

More...

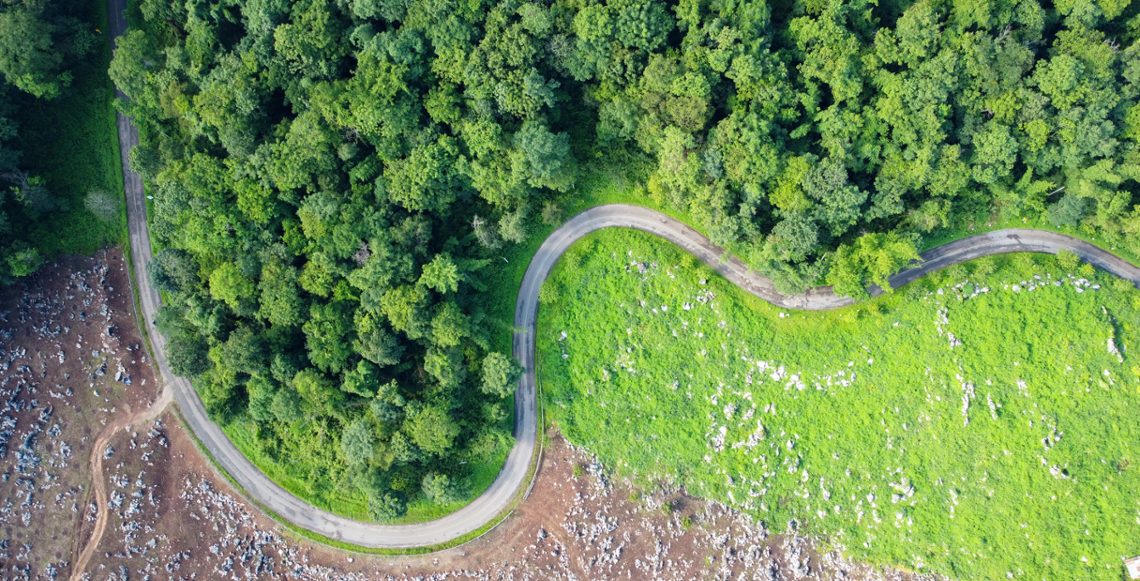

Infrastructure Outlook: Bridging the Valuation Gap

Opportunities continue to be widespread across the infrastructure landscape, with strong fundamentals and the market still massively underestimating the growth in electricity demand driven by AI and data growth.

More...