The risk-reward tradeoff facing the economy and financial markets skews unfavourably, although a positive trade shift or pivot to deregulation or tax cuts could reverse this.

Perspectives

Stay up-to-date with the current investment and macroeconomic issues at ClearBridge Investments. We provide analyses of the themes and trends which lie at the heart of your investment challenges.

Infrastructure Poised to Mostly Weather Tariff Storm

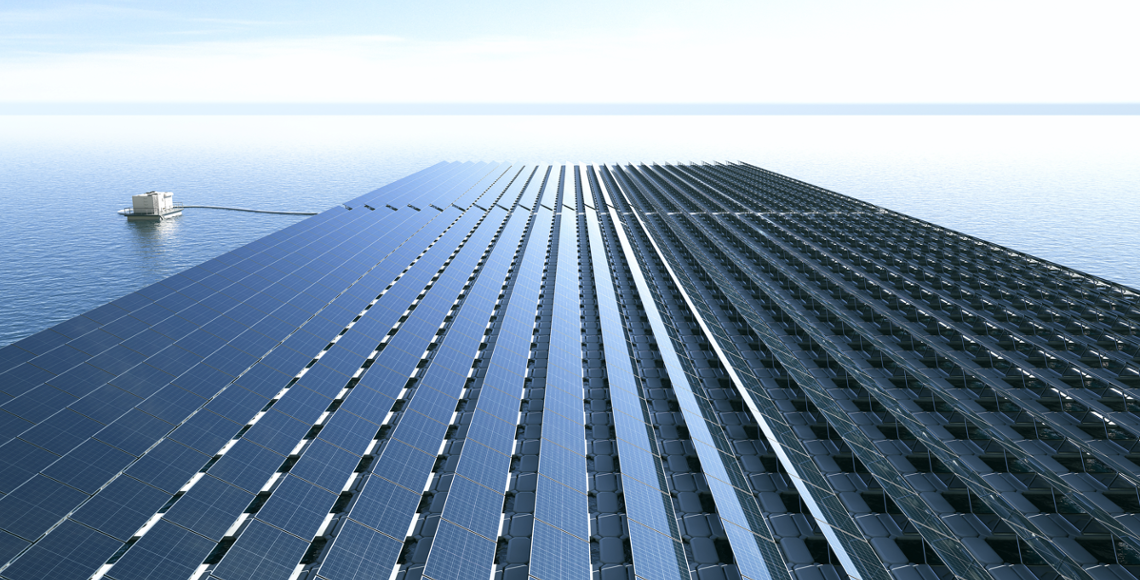

A new regime of tariffs will likely create the need for more infrastructure to support reshoring, while utilities' lack of exposure to international trade may bolster their defensiveness.

Read full articlePodcasts

Recorded by our fund managers; they share their views on what’s happening in global economies, the markets and our strategies.

Listen to our latest Podcast

ClearBridge Investments 2025 Stewardship Report

Our eighth annual stewardship report efforts offers an in-depth view of the latest in ESG integration and sustainability investing at ClearBridge, including how we are engaging with portfolio companies and voting proxies on pressing environmental, social and governance issues.

More...

Global Infrastructure Income Strategy April Commentary

Easing inflation in the U.K. helped water utilities there perform well, while passenger traffic resilience helped European airports; U.S. rails and pipelines were weaker on tariff and recessionary concerns.

More...

Global Infrastructure Value Strategy April Commentary

We remain confident in our utility and infrastructure assets and their ability to generate defensive, consistent and growing cash flow streams for shareholders over the medium-to-long term.

More...

Developed Markets Infrastructure Income Model April Commentary

Our global listed infrastructure strategies outperformed global equities and relevant infrastructure benchmarks for the month, as elevated trade uncertainty weighed on sentiment.

More...

Emerging Markets Strategy April Commentary

Emerging markets meaningfully outperformed developed markets over the month, which was mainly led by Brazil and Mexico, accompanied by recovery in China and India.

More...

The Long View: Diversification for Uncharted Waters

While the U.S. has outperformed long term, international equities tend to pick up the slack when domestic markets falter.

More...

The Rising Case for Non-U.S. Equities

Massive fiscal reforms in Europe and resolution of the Russia-Ukraine war could help close the leadership gap between the U.S. and the rest of the world.

More...

Developed Markets Infrastructure Income Model March Commentary

Trump’s policy agenda has so far been more disruptive than expected, and we anticipate uncertainty will weigh on U.S. growth.

More...

Market Turmoil Highlights Infrastructure's Stability

Q1 2025 Global Infrastructure Value Strategy Commentary: Infrastructure delivered positive returns in the first quarter, outpacing both global equities and U.S. equities, which were weaker amid higher policy uncertainty, specifically around tariffs.

More...

Infrastructure's Defensiveness Shines as Equities Unwind

Q1 2025 Global Infrastructure Income Strategy Commentary: Infrastructure’s defensive nature was rewarded in this environment, with regulated utilities leading returns, in particular in Europe and North America.

More...

International Does Heavy Lifting For a Change

Q1 2025 Global Growth Strategy Commentary: Global equities outside the U.S. outperformed as increasing policy uncertainty under the new Trump administration spurred investors to look overseas.

More...