Global ESG Outlook: More Scrutiny on Sustainable Investments

Key Takeaways

-

2022 delivered a series of firsts that should help improve the integration of ESG factors into the investment process as well as broader conversations around sustainability.

-

Regulation will remain a key topic for sustainability-minded investors in 2023 as it begins to have a greater impact on how sustainable investing strategies are perceived, evaluated and trusted by investors.

-

Biodiversity and human and labor rights will continue to grow as a focus for investors and companies, particularly for companies with operations or suppliers in emerging economies.

Finishing a Year of Firsts

It is an encouraging time for those integrating environmental, social and governance factors into the investment process, as 2022 delivered a series of firsts that should help improve that process as well as broader conversations around sustainability. But if you need a refresher on the ways sustainable investing advanced in 2022, you’re not alone.

Regulation Vetting Sustainability in Europe

Regulation in Europe took a step forward with the first year of implementation of the Sustainable Finance Disclosure Regulation (SFDR), which aims to improve transparency in the market for sustainable investment products and prevent greenwashing. The measure imposes comprehensive sustainability disclosure requirements covering a broad range of sustainability metrics and is an opportunity for managers to show they’re doing what they claim to be doing.

Managers maintain some discretion in deciding how SFDR requirements are met. For example, managers must disclose what percentage of a given fund’s assets target sustainable investments, though there aren’t prescriptive SFDR guidelines on what constitutes a sustainable investment and there is no minimum percentage requirement. This is appropriate in the early stages of implementing regulation as it allows a market-like environment to discover best practices and leaders. As we have seen elsewhere, intra-industry sustainability practices tend to converge over time as best practices are diffused. We expect the same for asset managers. Investors want fair, safe and efficient markets and transparency for all participants and the SFDR is a step in the right direction.

Names, Issuer and Investor Rules in the U.S.

The U.S. also stepped up in proposing sustainability-related regulation. This included the SEC’s recommended updates to the Investment Company Act of 1940’s “Names Rule,” which currently says funds whose names suggest a certain focus must invest at least 80% of their assets accordingly. The proposed amendment would expand what counts as “focus” to include sustainability factors. The SEC also proposed new climate-related disclosure requirements for public companies via the “issuer rule”; proposed amendments would require public companies to provide certain climate-related financial data, and greenhouse gas emissions, in public disclosure filings. The “investor rule” proposes that ESG-focused funds and firms disclose more specifics about their ESG strategies, for example in fund prospectuses and annual reports.

In addition, the Department of Labor issued a final rule that permits retirement plan fiduciaries, such as 401(k) plan sponsors, to consider climate change and other sustainability factors when they select investment options and exercise shareholder rights, such as proxy voting for plan-held securities.

For ClearBridge, 2022 marked another first on the climate front: our target-setting methodology as part of the Net Zero Asset Managers initiative was approved and is currently being rolled out. We published a case study with the UN PRI outlining a forward-looking approach to verifying net-zero alignment that corresponds with our investment goal of identifying companies that will maintain shareholder value and be successful well into the future, as well as with our fiduciary duty. In addition, we published a standalone Climate Report in line with the Task Force on Climate-related Financial Disclosures framework, where we discuss our approach to integrating climate-related risks and opportunities in our investment process firmwide.

Pruning a Fast-Growing Tree

Reflecting the further vetting of sustainable investing, 2022 was also the first year ESG assets under management decreased according to US SIF.1 The main reason for this change is not because of performance issues or client withdrawals from ESG accounts. Rather, US SIF raised the threshold for what ESG assets are, refining its methodology for counting ESG assets to require more granular information on the incorporation of ESG issues into investment decision making and portfolio construction. Bottom line: if a manager or institutional investor did not provide details on the ESG assets it claims to manage, those assets were not included in the report.

It’s easy to see why this makes sense. Going forward, regulators will also require disclosure of the processes and strategies used in managing ESG assets. US SIF wants to be reflective in its approach and is anticipating the views of regulators in how to more accurately assess ESG assets for reporting purposes. The result should be more transparent markets and more trust for sustainable investing intentions.

The Year Ahead: Regulation, Energy Transition, Biodiversity and Human Rights

Regulation will remain a key topic for sustainability-minded investors in 2023 as it begins to have a greater impact on how sustainable investing strategies are perceived and evaluated by investors. Beginning in January, Level 2 requirements of SFDR will include reporting on principal adverse impacts, though data on these remain difficult to gather, assess and compare. On a global basis, the number of regulatory initiatives jumped by ~37% from 2021 to 2022, with the European region leading, and the figures are expected to keep rising going forward (Exhibit 1).

Exhibit 1: Number of ESG Regulatory Initiatives

As of Oct. 3, 2022. Source: ISS ESG.

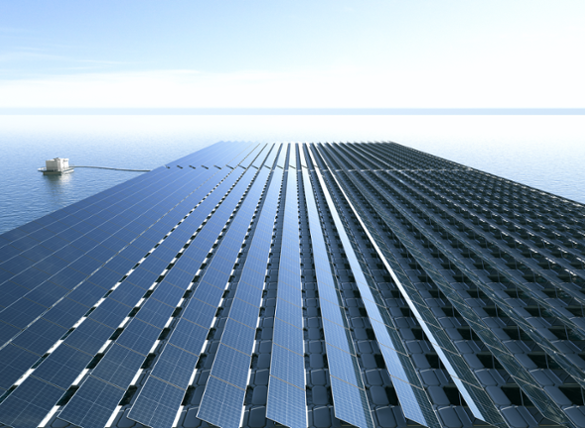

The clean energy transition will continue to dominate sustainability discussions, with the U.S. Inflation Reduction Act (IRA) creating more than a decade’s worth of spending and tax credits and offering long-term visibility on climate-friendly investments across sectors. The act offers tailwinds for renewable energy, further improving its cost competitiveness (Exhibit 2), as well as electric vehicle supply chains and companies helping the climate with solutions in buildings and energy efficiency. One caveat here is that it’s important to not lose sight of company profitability and the strength of the business model: in the long term, policy tailwinds are no substitute for strong fundamentals.

Exhibit 2: Changes in Levelised Energy Costs (with IRA) – Jan. 2021 – Sept. 2022

As of Sept. 29, 2022. Source: NextEra Energy Resources estimate. Natural gas comparison based on Electric Reliability Council of Texas pricing.

The IRA also turbocharges renewable energy deployment, jumpstarts emerging technologies like battery storage, clean hydrogen and carbon capture and storage, and incentivises U.S. manufacturing, while highlighting fair wages and the responsible production of minerals necessary for the energy transition.

Mineral production is a topic growing in importance and a current focus of ClearBridge engagements. Electrification requires large amounts of copper, for conducting electricity, and battery materials such as cobalt and lithium, for storing it. Mining these minerals entails substantial ESG risks. It is vital for clean energy storage investors to be responsibly involved in extractive industries, as we know mining can be tough on the environment. Many mines operate in emerging economies with substantial risks due to lower living standards, reduced social protections, and lax governance and environmental regulations. Extractive industries will yield many of the raw materials necessary for electrification; taking care of the land and the people on it will be paramount.

Biodiversity and human and labor rights also continue to grow as a focus, based on our company and industry engagements, in particular for companies with operations or suppliers in emerging economies, though developed market conditions need to be monitored as well. One survey of 51 institutional investors showed that biodiversity is expected to gain equal mindshare with climate change in 2023 (Exhibit 3). Biodiversity, or the variety of life on Earth and its interactions, is commonly perceived as the “less engaged environmental priority” next to climate change, and it is a fairly broad term we should be careful not to ignore. Impact themes ClearBridge regularly engages on, such as supporting regenerative agriculture, promoting responsible water management, minimising waste, developing a circular economy, and protecting and restoring habitats get to the heart of biodiversity as an investment theme. These are front and center in our company analysis and engagements.

Exhibit 3: Biodiversity Gaining in Prominence Among Institutional Investors

Source: Bernstein ESG Outlook Surveys, 2022 (n=53) and 2023 (n=51).

On the human and labor rights side, more investor disclosures are being considered by the SEC and, based on 2022 proxy trends, we should expect social shareholder proposals, which increased 17% year over year in 2022,2 to continue increasing in 2023. The main driver of that increase was the 81% growth in proposals on civil rights, human rights and racial equity impact,3 though roughly half of racial audit proposals were withdrawn after companies agreed to perform some form of audit — a sign companies are starting to see the value in this type of assessment.

In 2023 we should be on the lookout for more shareholder proposals related to climate disclosure and goals, political spending disclosure, EEO-1 workplace disclosure, enhanced disclosure of diversity of the board, cybersecurity, director qualifications, and other human capital management disclosures.

Scrutiny of ESG Calls for Clarity, but its Intention Has Been Constant for 30+ Years

In the past year, there has been a fair amount of public discussion, as well as some politically motivated action, around ESG investing, prompting some to even position themselves as “anti-ESG.” Unfortunately, in our view, some of the discussion in the U.S. focuses more on misperceptions than the underlying investment practice.

One misperception is that ESG investing is new. As practitioners of sustainable investing for 35 years, we have used a variety of names for our investment approach since we first began integrating environmental, social and governance factors into our investment analysis in 1987, including socially responsible investing (SRI), socially aware investing (SAI) and, today, ESG investment. While the term “ESG” has received a lot of attention, as has “greenwashing,” ESG investing is not a new “trend” for ClearBridge. We stayed with the term ESG after helping to coin it in 2004 with our United Nations Environment Programme Finance Initiative Asset Management Working Group partners, as, practically speaking, we believe every investment has environmental, social and governance risk and return implications.

Other misperceptions garnering attention involve “values” and investing. Some perceive the priority for ESG investors to be divestment from certain industries such as fossil fuels. In reality, however, only 13% of U.S.-domiciled ESG strategies actually have fossil fuel exclusions (Exhibit 4).

Exhibit 4: U.S. ESG Funds Less Likely to Divest from Some Controversial Categories

As of November 2022. Source: Morningstar, Goldman Sachs Global Investment Research.

Similarly, there has been a long-held assumption that ESG investors focus primarily on “values,” and in doing so create an exclusionary approach (such as excluding tobacco companies, weapons companies, etc.). But in our review of a representative U.S. stock universe, we found only 4% of the universe was excluded by such screens (the most common for U.S. ESG funds).4

As investment managers, we don’t view values as exclusionary, but rather, as complementing a diversified sustainable investment strategy with financial and societal impact as we look to provide competitive risk-adjusted returns over the long term. From our standpoint as practitioners, the vast majority of our time is spent not excluding investments, but building a prospective, future-focused and inclusive portfolio of companies with strong fundamentals that we believe will be able to sustain those strengths over time.

Divestment from fossil fuels is one strategy for investors seeking to support the energy transition, but it is not as commonly used by ESG investors as some headlines would suggest. To complicate the story, many fossil fuel companies are adapting to support a greener future, and there is energy alpha outside the traditional energy sector, in tech and industrials, for example. As noted above, ESG investors have other investment options in energy (as a sector), such as clean and renewable energy where demand and pricing have expedited the growth trajectory. These issues deserve careful consideration from fundamental investors across the industry.

With investors, employees and other stakeholders continuing to press for climate and diversity policies and disclosures, and companies and their boards navigating increasingly complex legal and regulatory environments, ESG will remain a priority in 2023. Whether mandated by governments or initiated by companies to create long-term shareholder value, mitigate risk or respond to campaigns by investors, customers, employees and other stakeholders, we can look forward to more efficient and transparent sustainable investing in 2023. Through active investment and engagement, ESG should maintain and grow its prominence in the business landscape.

Related Perspectives

ClearBridge Investments 2025 Stewardship Report

Our eighth annual stewardship report efforts offers an in-depth view of the latest in ESG integration and sustainability investing at ClearBridge, including how we are engaging with portfolio companies and voting proxies on pressing environmental, social and governance issues.

Read full article