Our Approach to Sustainability & ESG

Incorporating Sustainability in the Infrastructure Investment Process

Since inception, the inclusion of sustainability and ESG factors has been a core part of our investment processes, and we have always approached the ownership of equity in listed companies from a long-term and sustainability-driven perspective.

In Australia for the infrastructure strategies, we do not defer sustainability analysis to a dedicated ESG analyst, rather it is a responsibility of all investment team members. We integrate ESG factors into our fundamental analysis and assign proprietary ESG ratings to our investments. Our team believes that integrating sustainability into the investment process supports our responsibility to our clients in achieving their investment goals.

ClearBridge Investments is a signatory to the United Nations Principles for Responsible Investment (“UNPRI”) and reports annually on the implementation of those principles. ClearBridge Investments also supports the principles of the UN Global Compact (“UNGC”). Our Compliance team monitors compliance with the ten principles in each of the four areas (human rights, labour, environment and anti-corruption) of the UNGC on a daily basis for our infrastructure investment strategies. If a violation is identified, any impacted portfolio/fund is required to sell out of the position as soon as reasonably practicable. Our investment process also considers the Sustainable Development Goals (”SDGs”) by mapping issuers against each one of the SDGs as a proxy for determining a positive Environmental or Social contribution.

Infrastructure Strategies - Governance

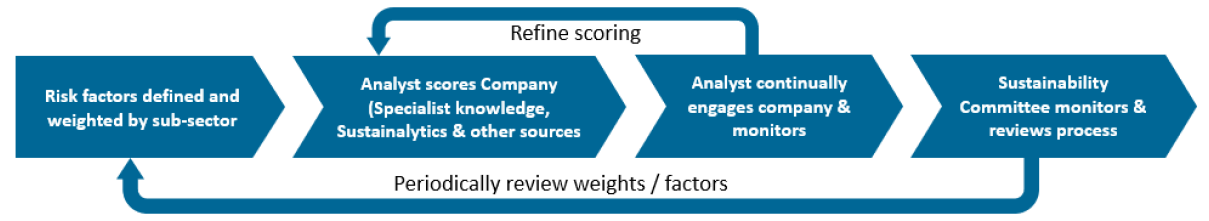

The ClearBridge Infrastructure Sustainability Committee consists of two Portfolio Managers as well as members of the global ESG strategy team. The Committee is responsible for managing the overall sustainability of the infrastructure investment process.

Proprietary Systems and ESG Ratings Manager

ClearBridge Investments applies a Research Management System, comprised of the proprietary ESG Ratings Manager (“ERM”) and an ESG Engagement Management System which additionally features an Engagement for Impact (“EFI”) component, permitting the firm to track and monitor specific questions with the ESG goals of selected companies.

ClearBridge uses the ERM platform for building and internally sharing ClearBridge ESG ratings and their rationales. The platform allows for an easily accessible common language for ESG factors that provides transparency and consistency of methodology in assigning ESG ratings to companies across the firm. This system combines:

- internal research and analysis;

- supplementary information and data obtained from a variety of third-party research providers; and

- engagement with company management and non-executive directors and other industry experts.

The ERM assesses and scores sustainability risks and opportunities across a range of factors. Depending on the infrastructure subsector, these factors are weighted according to importance and broadly focus on:

- Environmental factors such as a company’s environmental practices, GHG emissions and energy efficiency initiatives;

- Social factors such as a company’s approach to community relations;

- Governance factors such as the governance structure of the company, our alignment (as a minority shareholder) with the management, board and other major shareholders of the company management and board quality including operating excellence, diversity and remuneration practices, amongst others;

- Ethical factors including management and board integrity and quality (e.g. anti-corruption measures, compliance, and ethical conduct); and

- Labour standards such as employee health and safety and management.

By weighting these factors across subsectors, the importance of specific risks or opportunities are reflected as well as a company’s exposure to them. This system also enables comparability across the investment universe. Individual factors and their weightings are reviewed periodically by the Sustainability Committee.

Integration into Investment Decision Making

As part of ClearBridge’s fundamental bottom-up investment process, it considers environmental, social, governance, and ethical factors and labour standards (ESG factors) in determining whether to include, retain or exclude securities within the investment universe for each portfolio/strategy. This information is utilised as part of the investment process by the portfolio managers when integrating ESG and fundamental research in stock selection.

As part of this process, various screens are employed in accordance with the investment strategy of the particular sector or subsector. Amongst other screens, ClearBridge will not invest in companies that:

- directly generate any gross revenue from tobacco production but may invest in companies that indirectly generate 5% or less of their gross revenue from the supply or retail of tobacco;

- directly generate any gross revenue from the production of adult entertainment but may invest in companies that indirectly generate 5% or less of their gross revenue from the distribution or retailing of adult entertainment;

- have any direct involvement in the production of cluster munitions, landmines, biological weapons, and chemical weapons;

- directly generate 10% or more of their gross revenue from the production of conventional weapons; and

- directly generate any gross revenue from commercial gambling operations but may invest in companies that indirectly generate 5% or less of their gross revenue from the licensing or supporting activities of gambling.

Additional screens may be applicable in accordance with client specific instructions.

In addition to exposure concerns, the infrastructure team also take into account quality concerns, where we assess the company’s business model and operating environment, including:

- Sovereign interests (authoritarian or oppressive regimes);

- Legal environment; and

- Regulatory environment.

The investment team then incorporates sustainability analysis into the investment process and portfolio construction via three main pillars:

1. Valuation (cash flow forecasts) – where appropriate, our analysts incorporate sustainability into our cash flow and terminal value forecasts. Examples include the cost of emitting carbon for large power utilities, the cash flows related to asset-based growth from storm hardening investments or the impact of technological innovation on the useable life of existing assets. Sustainability research may directly affect our valuation of companies to the extent that it affects our assessment of cash flows. For example, companies may need to invest in mitigating the impact of climate change, and such investments need to be reflected in financial forecasts as a part of scenario analysis. In most cases, the majority of the Sustainability IRR impacts are captured via cashflow adjustments.

2. Risk pricing (required return adjustment) – the expected internal rate of return from each infrastructure security is compared with a required return, or ‘hurdle rate’ for each investment. The required return captures sustainability factors that cannot be priced into cash flows (the standard discount rate in our financial models had reflected a rating for corporate governance & management since June 2006 and environmental and social factors since 2012). As part of this assessment, we make explicit adjustments for sustainability risks and opportunities as determined by our ERM. For the top ESG rated company we apply a reduction to the required return to capture the improved risk profile and for the lowest rated we increase the required return. For companies in between we scale the required return adjustment relative to their ESG rating.

3. Engagement and proxy voting (active management) – our infrastructure investment team believes that sustainability factors are an essential aspect of company performance. By integrating sustainability considerations into our investment process and approaching the ownership of equity in listed infrastructure companies from a long-term perspective, we are exercising our responsibility as an investment manager to act with the best interests of our clients in mind. The ability to engage with company management teams is paramount and, as a result, we do not invest in the securities issued by companies with which our analysts cannot engage.

Our team think of “active ownership” as the supporting of good corporate governance and the pursuit of change where we believe sustainability practices are weak or less than ideal. On behalf of our investors, we perform our active ownership duties in three main ways:

- Voting at company meetings - in voting proxies, our team is guided by general fiduciary principles. Our goal is to act prudently, solely in the best interest of the beneficial owners of the accounts we manage. We attempt to provide for the consideration of all factors that could affect the value of the investment and will vote proxies in the manner that we believe will be consistent with efforts to maximise shareholder values.

We use the opportunity to engage with the management, boards and other shareholders on sustainability issues and actively use our voting rights (where practicable) to reinforce our and our client’s views on sustainability issues. We take an active interest in casting votes at annual general meetings and extraordinary general meetings. Our investment team reviews resolutions, taking into account sustainability issues where appropriate.

Although each vote is assessed on a case-by-case basis, the portfolio managers generally support shareholder proposals that promote good governance, greater corporate transparency, accountability and ethical practices. For further information please refer to our Proxy Voting Policy which sets forth certain stated positions, including in relation to ESG proposals.

- Engagement with company management, board and industry participants - when we determine to invest in a company, we expect to do so for some years, and our relationship with the company’s board is an important part of our process. The investment team engages with company management on sustainability and related issues in regular meetings with key management and non-executive directors. These discussions seek to provide feedback to companies on:

- Corporate strategy, encouraging consideration of long-term value creation and long-term risk management including sustainability issues;

- Capital management and structure; and

- Executive remuneration and incentive schemes, ensuring that executive remuneration is both appropriate for the asset and incentives are aligned with the interest of long-term shareholders.

In addition to executive management, the investment team engages with non-executive directors such as the chair, where this is separate, and the supervisory board in a two-tier structure. Discussion topics include, among other issues:

-

- Remuneration policy of the board, in particular decisions around incentive pay;

- Succession plans for the senior leadership team and the next level of executives;

- Governance structure; and

- Sustainability strategy.

- Incorporating alerts and controversy data - our investment team continually monitors the sustainability performance of companies and incorporates changes to our view of a company and its inclusion in portfolios. In this regard, our team actively monitors company alerts related to sustainability matters. Where alerts raise concerns or highlight opportunities, analysts engage with the management, revisit the company’s proprietary ESG ratings and communicate relevant changes to ensure the latest information is included for portfolio construction decisions.

Alerts are reviewed by our analysts and discussed at weekly portfolio meetings to ensure the latest information is incorporated into our view on a company. As previously mentioned, for UNGC monitoring specifically, our compliance team uses a third-party data provider to monitor compliance on a daily basis.

Alerts are particularly valuable for:- Providing early indicators of potential risks or improvements in sustainability practices that can be incorporated into sustainability scores and portfolio construction.

- Indicating broader issues, particularly where the alert frequency is elevated; this can indicate poor governance factors, even if alerts are low-level in terms of risk.

- Offering a useful source of recent data with which to engage management and address sustainability matters.

Evolution of Sustainability Process

ClearBridge has continually evolved its sustainability processes and methodologies, since initially incorporating a governance factor at inception in 2006, expanding this to ESG factors as Sustainalytics’ first Australian client in 2012 and continuing to evolve the process to the current ERM. We will continue to enhance the process as information, opportunities and risks associated with sustainability change.